S&P 500 Daily Trade Plan: The 150-Point Squeeze & The Globex ATH Target

A detailed ES & VIX plan for Feb 3rd, breaking down the 7022.25 Breakout Pivot and the 7043 Cash Session Target.

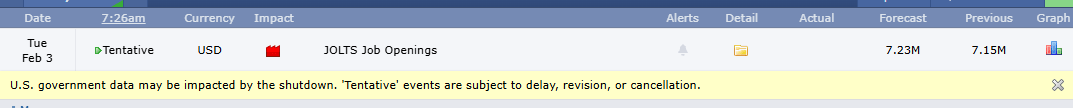

Scheduled News

Options Volatility Levels

Good Morning Everyone!

Today is February 3rd. We come off an amazing day yesterday in the trade plans as we called the low after a 90-point flush at 6867.25, leading us to a 150-point squeeze yesterday. An absolutely insane day for our members who banked unreal profits thanks to the trade plans. Congratulations to everyone who followed along. It couldn’t be more excited for everybody—just another phenomenal example of what happens when you follow a professional trade plan.

A Note on Today’s Market:

News: 8:30 AM JOLTS Job Openings (Red Tag). Note: With the government shutdown, this is tentative.

Range: Expected range of 87.50 points. We have moved 25 points, leaving roughly 60 points left in the tank.

Volume: Relative Volume is -37%. This could bring our expected move closer to the 50-point range. Expect a slow grind.

Gamma: We are in Negative Gamma until 7075. This creates increased volatility as dealers hedge to the downside.

Trend: Bias is Up. We are balancing at the highs, seeking new All-Time Highs.

🧠 Current Market Context

The Globex Target:

As we sit here balancing at the highs, we continue to test our overhead resistance and appear prepared for a breakout. We have an All-Time High that was made in the Globex session on Jan 27th (7043). As I’ve stated many times, All-Time Highs created in Globex become Targets for the cash session. This is clearly what we are gunning for today.

Sideways Drift:

Yesterday, after this massive push-up, we continued to move sideways again, staying above our significant weekly at 7004.00. We have been drifting all night in a tight range of 25 points as the market accepts value at these highs.