S&P 500 Daily Trade Plan: The Double Bottom Watch & 6903 Pivot

A detailed ES & VIX plan for Feb 18th, breaking down the FOMC minutes, the 6880 momentum shift, and the massive 6903 resistance wall.

SCHEDULED NEWS

OPTIONS VOLITILITY LEVELS

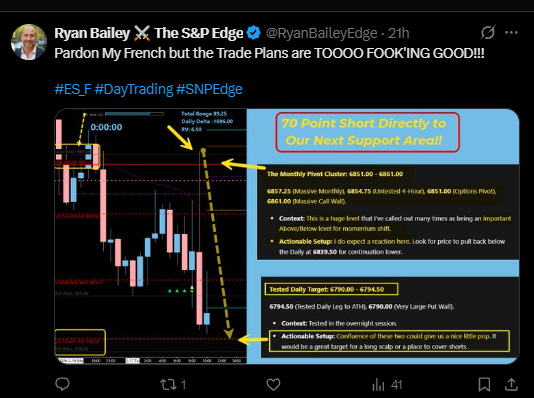

Morning everyone. Today is February 18th and we come off an absolutely gangbusters day yesterday. Our trade plans were so amazing that we caught the pre-market long, the post-open short, and we had the low of the day that took us all the way to the 6880.00 short at the high. It was absolutely unbelievable—probably one of our best trade plans ever. Congratulations to the team who took advantage of this as we had some serious profits put on the board. I am so proud of all of you.

A Note on Today’s Market:

News: Minimal Red Tag news. 2:00 PM FOMC Meeting Minutes. More than likely we’ll get an algo shake, but this isn’t anything we need to be overly concerned about. Just be aware of the time.

Volume: Relative volume is fairly flat at -3%.

Range: Expected range of 100 points. We have moved 55 points in the overnight session, leaving approximately 45 points left in the tank. This is a pretty good range and a lot of money will be made today.

Gamma: We are still currently in Negative Gamma territory. It has started to shift down, but we are still suppressed by dealer hedging to the short side. This ensures volatility and that money can be made in both directions.

🧠 Current Market Context

The Double Bottom Potential vs. Downside Trend

Technically speaking, all things point to more down. We have still not gained on the Daily timeframe, the 4-Hour timeframe, or the Weekly timeframe. However, as of right now, the ES has held the leg low and could potentially be making a double bottom. This is why we need to be extremely careful and monitor our pivots today.

The Sandwich:

We are sandwiched right now. Above 6904.00, we push higher and momentum is in the favor of the Bulls. But below 6880.00, things shift significantly back in the favor of the Bears, pushing us below the previous Weekly VAL and underneath yesterday’s high, putting us right back in yesterday’s range. Today is certainly not a day to guess.