S&P 500 Daily Trade Plan: The 7004 Make-or-Break & The 6964 Momentum Shift

A detailed ES & VIX plan for Feb 10th, breaking down the Retail Sales volatility and the critical 7004.50 Untested Leg.

Scheduled News

Options Volatility Levels

Today is February 10th. We are coming off another exciting day as our trade plan has proved to be extremely fruitful. We were able to call the 6977.75 Weekly in the Weekend Review, which paid over 50 points in the overnight session, bringing us down to hold our 6923 major pivot. This squeezed us up over 75 points in the cash session. Our Substack subscribers and Discord members were able to reap massive gains on yesterday’s moves. Congratulations to everyone who took advantage of this.

A Note on Today’s Market:

News: 8:30 AM Retail Sales (Red Tag). This is sure to give the market some volatility as we have been on a squeeze mission for the past two sessions, leaving us thin on support below.

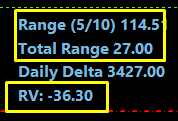

Volume: Relative Volume is -41%. This means we could see an expected move somewhere around 60 points in the cash session.

Range: Expected range of 114 points. We have moved 25 points in the overnight (extremely tight), leaving approximately 90 points left in the tank.

Gamma: We are in Negative Gamma. The Gamma Flip remains at All-Time Highs (7050). Dealers are hedging short; expect extreme volatility and money made both ways.

🧠 Current Market Context

The Make-or-Break Spot:

As many of you know, I’ve been calling for an extreme reaction potentially around the 7004.50 area. We missed this yesterday by only a few points; however, this is still our highest untested Daily leg to the low and an untested Weekly. In my opinion, this is the Make It or Break It spot for the ES. We either get a reaction here and come down significantly hard, or we break above and push to All-Time Highs.

SPX Context:

SPX moved into our upper untested Daily area (6977) yesterday and remained sideways. Be aware this is the highest untested Daily leg to the low. If we are going to get a reaction, it’s going to happen here.