S&P 500 Daily Trade Plan: The 120-Point Overnight Sweep & Negative Gamma Volatility

A detailed ES & VIX plan for Feb 6th, breaking down the 6765 Overnight Sweep, the 6883 Bearish Pivot, and the 6903 “Smack” Zone.

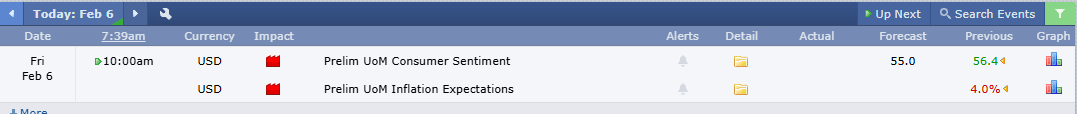

Scheduled News

Options Volatility Levels

Good morning everyone. Today is February 6th, it is Friday, and it is guaranteed to be a wild day. We come off an incredible day yesterday where we called the top, the bottom, and everything in between. We literally had the top short to the tick which paid well over 80 points, including the call out of the sweep of the lows which paid another 60 points. This has been an incredible weekly run for our Substack subscribers and Discord members. We have absolutely cleaned up, putting up record numbers with insane precision. Congratulations to everyone who took advantage of this—I salute you!

A Note on Today’s Market:

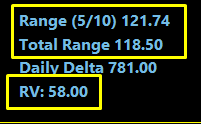

Volume: Relative Volume is elevated at 57%. Market participants are here to play (bringing an extra 57% above normal).

Range: Expected range of 121 points. We have already moved 118 points.

Gamma: We are in Negative Gamma (Flip > 7000). Expect extreme volatility. Dealers are hedging short, looking for potential downside, but money can be made both ways.

Momentum: We are currently Bearish (below 6883/6903).

Overnight: Insane move from lows, playing the 6765/6761.75 massive weekly/daily area (Prime Buy Spot) and sending price up over 120 points.

🧠 Current Market Context

The Bearish Momentum

Currently, we are still below our major Weekly triggers at 6883 and 6903. Just being underneath these levels alone creates bearish momentum that we need to be aware of. Until we can get back above these levels, we have some serious overhead resistance to work with.

The Volatility Factor

We come into the day once again with extreme volatility on the radar. With an elevated Relative Volume of 57% and Negative Gamma, we will more than likely move another 50 points on top of our expected range (above or below the overnight high).