S&P 500 Daily Trade Plan: The 100-Point Squeeze & End-of-Month Volatility

A detailed ES & VIX plan for Jan 30th, breaking down the 6903 Hold, the “Wing Play,” and the Warsh/Tariff Volatility.

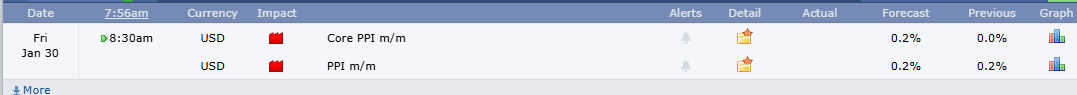

Scheduled News

Options Volatility Levels

Morning everyone. Today is January 30th, it is Friday, and we’re coming off another fantastic day of the trade plans. Yesterday, for all the subscribers, we caught the low at 6903.00 that launched us 100 points.

We went over it in the Weekend Review the Sunday prior and yesterday in the Post-Market Breakdown—how we nailed the trade and how it’s one of my signature trades. If you get a chance to watch this, make sure you check it out, as this could be extremely formative for you guys in the future. Congratulations to all those who cashed in on this 100-point squeeze, as it is the first large move of the year and we nailed it. Congrats!

A Note on Today’s Market:

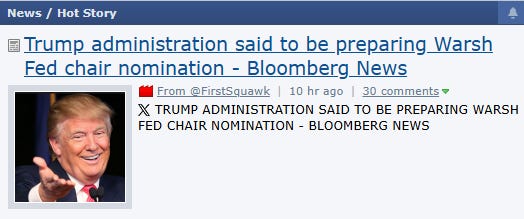

News: 8:30 AM Core PPI & PPI MoM (Red Tag). Trump put tariffs on Mexico and Canada last night (causing a 60-point drop). Trump is also nominating Kevin Warsh for Fed Chair—markets are undecided.

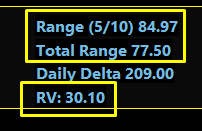

Volume: Relative Volume is up 32%. Traders are here to play today.

Range: Expected range of 85 points. We have already moved 77.5 points, leaving approximately 10 points above/below the overnight high or low.

Context: After a 120-point sell-off, we played the “Wing Play” at the weekly. Currently holding the lows at the significant 6903.00 area, making a potential W/Double Bottom.

🧠 Current Market Context

End-of-Month Caution

We are coming into the day with Red Tag news pending. Last night’s tariff news caused volatility, bringing us down over 60 points in the overnight, however, we are still holding the lows. It will be an interesting day, but I advise everyone to be cautious as Fridays tend to be extremely volatile, especially coming into the end of the month.

The “Wing Play” & Bullish Bias

Technically, this trade signifies that we could make new All-Time Highs; however, we never know what’s going to happen. But as of right now, the pullback at the overnight lows has held, and we are currently holding our significant 6903.00 area. It is my opinion that right now we are still very much bullish and can continue to make All-Time Highs as long as we hold our significant weekly and can look to clean up our bullish imbalance all the way to 7069.25.