S&P 500 Daily Trade Plan: Surfing All-Time Highs as Shutdown Fuels Bull Run

A detailed ES futures trade plan for October 2nd, focused on price discovery, a key sweep-and-reclaim setup at 6756.75, and why the market remains “insanely bullish.”

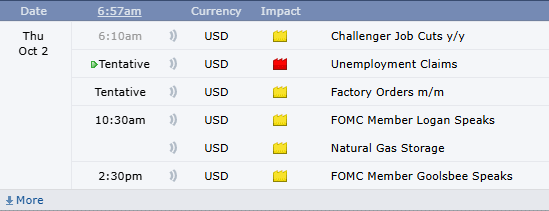

SCHEDULED NEWS: SAYS TENATIVE = GOVERNMENT SHUT DOWN = NO NEWS

Good morning, everyone. Today is Thursday, October 2nd, and we are surfing all-time highs once again. Yesterday’s government shutdown news, which would typically cause uncertainty, did not seem to affect this market whatsoever. In fact, they bought the dip immediately and continued to push in an extreme fashion, giving us seven green 4-hour candles in a row.

The market dynamics this morning are fascinating. The shutdown has ironically created two bullish tailwinds: first, the Red Tag News for unemployment claims was canceled, removing a potential risk event. Second, the market is now pricing in a 100% likelihood that the Fed will lower interest rates later this month. This correlation has fueled another push higher overnight as we approach our long-standing bullish imbalance target.

🧠 Current Market Context

As we drift higher in this price discovery phase, things continue to look insanely bullish. We have no true overhead resistance, only target levels. The immediate goal is the completion of the bullish imbalance we’ve been targeting all week at 6782.00. The structure is clear: this is still a “buy the dip” market until proven otherwise. Today will likely be a grinder of a day as we establish value at these new highs, but the trend is undeniably up.