S&P 500 Daily Trade Plan: Shutdown Volatility and Insane Volume Grip the Market

A detailed ES futures trade plan for October 1st, navigating a government shutdown, high volume, and a critical developing setup around the 6696.00 pivot.

SCHEDULED NEWS

Good morning, everyone. Today is October 1st, and the market is giving us a lot to digest right out of the gate. We officially have a government shutdown, born from a political feud, which adds a significant layer of uncertainty. On top of that, we are opening with a relative volume of over 80%—an insane number that tells us the major players are out in force this morning.

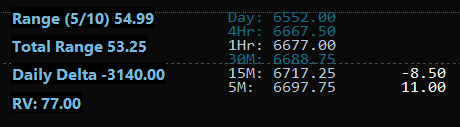

We had a pullback in the overnight session that perfectly tested our 6685.00 daily and a massive put wall, but we’ve since bounced. Despite the bounce, we are still down about 28 points from yesterday’s close. The market has already met its average daily range of 55 points, and I expect we will exceed that today. We also have Red Tag News with the ADP report pre-market, which could add to the shake. Let’s get into the levels and figure out our plan.

🧠 Current Market Context

The government shutdown and the wild volume create a backdrop for extreme volatility. The market could technically go either way as we are still sitting in a state of balance, contained between yesterday’s support around 6693.00 and the major resistance at 6716.50.

I have to admit, I’m not particularly fond of the way the 4-hour chart came down and closed last night. While the trend hasn’t technically been lost, it’s enough to make me err on the side of caution. We will default to the direction of the trend for now, but today requires patience. We need to let the market prove itself before committing heavily at the current price.