S&P 500 Daily Trade Plan: Short Squeeze Reclaims Key Pivot, But Massive Resistance Looms

A detailed ES futures trade plan for October 15th, analyzing the reclaimed 6660.00 pivot and the “spot of all spots” resistance cluster at 6767.00.

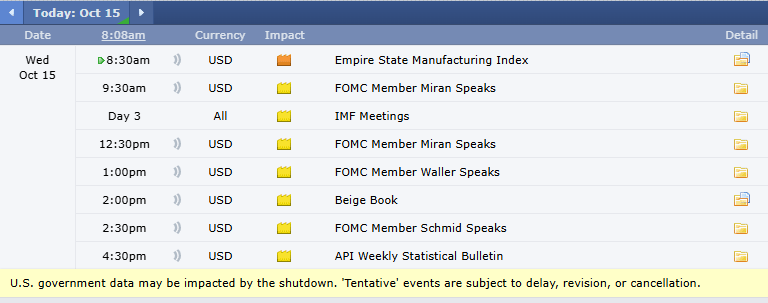

SCHEDULED NEWS

OPTIONS VOL LEVELS

Good morning, everyone. It’s Wednesday, October 15th.

Yesterday was an insane rally. We witnessed one of the biggest short squeezes we’ve seen in a long time—a 100-point push that took out both the overnight low and high. Responsive buyers showed up right where they needed to, at Friday’s low of 6595.00, and pushed price directly into our major resistance at 6660.00. Once price propelled over that area, there was no stopping the bulls. That daily leg end has been our huge pivot for weeks, and its reclamation is a significant development.

🧠 Current Market Context

After playing our signature “wing play” at the close yesterday off the 6664.50 daily leg, the market has pushed up another 50 points overnight. It shouldn’t come as a surprise that we are continuing higher; this market has proven it cannot be faded. However, we must be careful. With Fed speak scheduled all day, and as we approach a significant wall of resistance, we need to be prepared for a reaction. It is very difficult to be bearish now that price is above 6660.00, but if this thing is going to get nailed, the area directly above us is the place for it to happen.