S&P 500 Daily Trade Plan: Precision Levels Hit, Now What?

A detailed ES futures trade plan for November 6th, focusing on a new 6815.00 support leg and the key VIX pivot at 17.35 after a 30-point overnight pop.

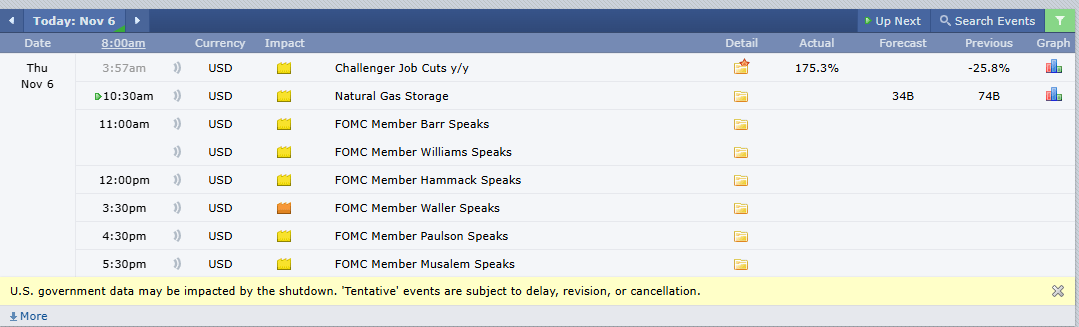

Scheduled News:

Options VOL Levels:

Good morning, everyone. It’s Thursday, November 6th.

Yesterday was a phenomenal day. Our trade plan was so ridiculously spot-on it was incredible. We discussed in the post-market breakdown (link below) how 6805.50 was an untested daily that could play overnight, and lo and behold, they tested it twice. We are now up over 30 points from that level. The precision has been extreme, and congratulations to everyone who has taken advantage of these plans.

🧠 Current Market Context

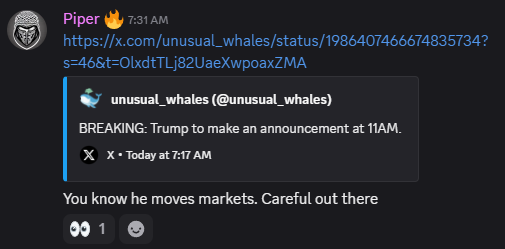

The market is potentially bottoming out, with signs on both ES and SPX, but we must remain cautious. We have no Red Tag News today, but be aware that Trump is scheduled to make an announcement at 11:00 AM EST, which could cause a shake.

We are currently in a two-day balance, sitting in yesterday’s value area. Volume is building for a move, and given the structure, we are leaning to the upside. Our bias is to defer to the trend, especially after the cash session test of the 6788.50 weekly yesterday, which is the reason I am still very much bullish.