S&P 500 Daily Trade Plan: Post-FOMC Upside & The ATH Target

A detailed ES plan for Jan 29th, breaking down the All-Time High Cash Target and the 6996 “Must Hold” Support.

Scheduled News

Options Volatility Levels

Good Morning everyone! Today is January 29th, it is Thursday. We come off a huge day post-FOMC where we had two amazing longs yesterday. The 6995.00 4-Hour held and played for 35 points, and then again the epic long at 6977.75 Weekly that played to the tick for over 50 points. We are still getting momentum from that right now. Congratulations to all those who took advantage of the trade plans; yesterday was an extremely beneficial day for those who were patient.

With that being said, we come off of FOMC with an upside bias now that the dust has settled. Just as predicted in yesterday’s post-market breakdown, we have come into the morning with a negative relative volume, giving us a bias for potential grind mode as we are a stones throw from ATHs.

A Note on Today’s Market:

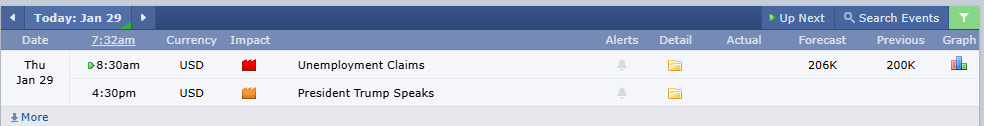

News: 8:30 AM Unemployment Claims (Red Tag - expect a shake). 4:30 PM Trump speaks (Post-Market - expect insanity).

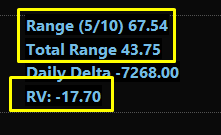

Volume: Relative Volume is -18%.

Range: Expected range of 67.50 points. We have moved 43.75 points, leaving approximately 25 points left in the tank above or below.

The ATH Rule: We made an All-Time High in the overnight session. The cash session does not allow these to sit there for very long. This will be our Target today as long as we remain in our bullish structure.

🧠 Current Market Context

Post-FOMC Digest:

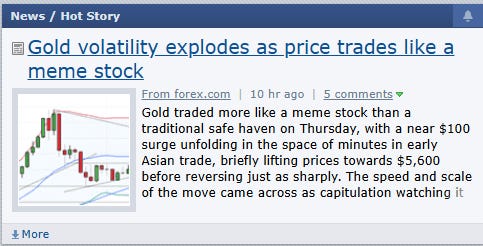

Digesting yesterday’s Fed information, there is nothing that we don’t know. They did not raise rates, and forward guidance was on par with a continued bullish cycle. However, with the insane volatility in Metals and the US Dollar, we certainly have to be on point just in case.

The Pivot:

Currently, we are sitting above our major All-Time High daily leg down at 7016.00. This is going to be one of the significant pivots that we’re going to monitor for Above or Below.