S&P 500 Daily Trade Plan: Navigating an Insane Reversal with Key Pivots

A detailed ES futures trade plan for October 17th, breaking down the critical 6660-6673 pivot, a make-or-break short setup at 6732, and why this massive squeeze might be a trap.

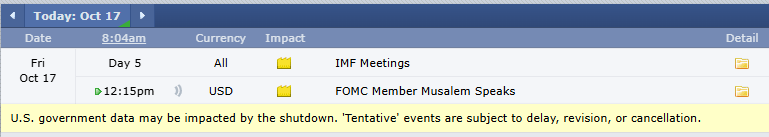

SCHEDULED NEWS

Good morning, everyone. It’s Friday, October 17th.

Yesterday’s trade plan was epic. We caught the top of the day at 6750.25 for a 120-point short down to the leg end, which was our buy area at 6630.50. Between the high, the low, and the continuation short under our 6706/6703 pivot, our subscribers made a fistful of money. Congratulations to all of you who took the initiative to make the day count.

🧠 Current Market Context

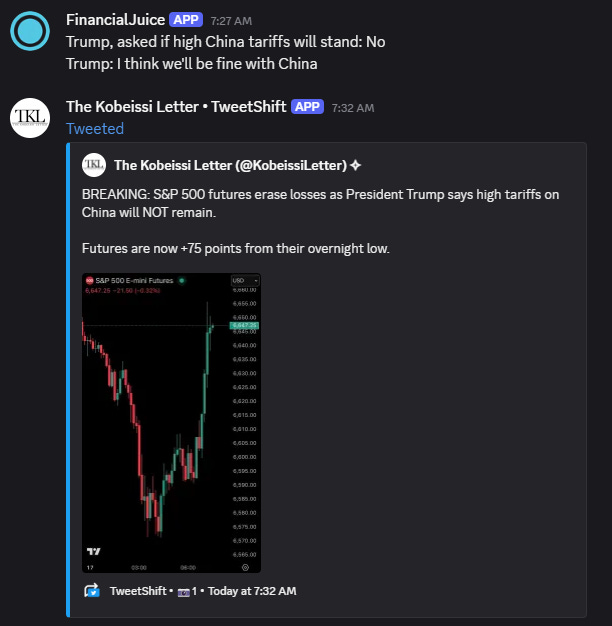

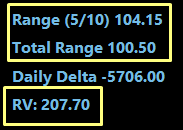

We are seeing one of the most volatile markets in recent memory. Relative volume is up over 208%, the most I have ever seen it. This is based on Trump tariff news, where he appears to be back-pedaling to prop up the markets. The result was an insane overnight session: after being down 95 points, the market squeezed over 90 points to be down only 6 as of this morning.

However, do not be misled. While a reversal is possible, I think there’s a chance this massive squeeze is just another pop-up in order to smack us down one more time. The market is structurally weak, with both the 4-hour and daily timeframes confirming more weakness. Money can certainly be made both ways today, so let’s get into the levels.