S&P 500 Daily Trade Plan: Navigating a Tricky Spot After a 50-Point Reversal

A detailed ES futures trade plan for November 5th, focusing on the critical 6805.00 pivot and “my favorite” support zone at 6738.75.

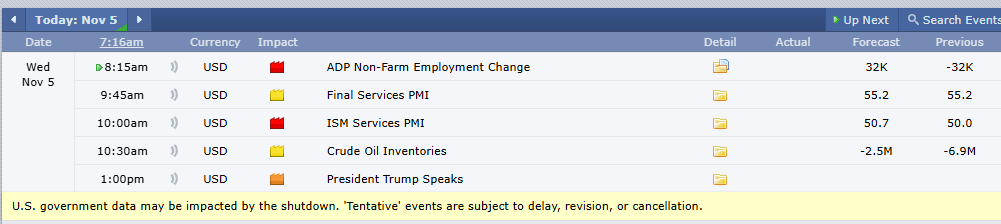

Scheduled News:

Good morning, everyone. It’s Wednesday, November 5th.

Yesterday was a phenomenal day. We saw a beautiful squeeze after the overnight low played our significant weekly at 6788.50. As instructed, price got back above the 6805.00 daily and 6812.00 (the previous all-time high), and we squeezed all the way to 6849.00. It was a phenomenal 30-40 point long, and everybody in the room made money.

Now, the market has drifted lower overnight, erasing almost all of last night’s 60-point slide. We’ve come into a more significant area of support and are getting a nice 50-point bounce from the overnight lows.

🧠 Current Market Context

We have some potential catalysts today. Red Tag News for ADP (8:15 AM) and ISM (10:00 AM) are on the schedule, but given the shutdown, we don’t know if they will happen. The real wildcard is the Supreme Court hearing on Trump’s tariffs. If they rule the tariffs illegal, it could disrupt his entire presidency, and the market would be distraught. This could cause a massive move in either direction.

We are not in a fantastic location for a new buy. A pullback would be preferred. Otherwise, the only other option is to buy a breakout above 6805.00. We are in a very tricky spot, so we must stick to the plan.