S&P 500 Daily Trade Plan: Navigating a Huge FOMC Day

With a Rate Cut Imminent, Here's How to Trade the Key 6583.25 Pivot and the Deeper Buy Opportunities Below.

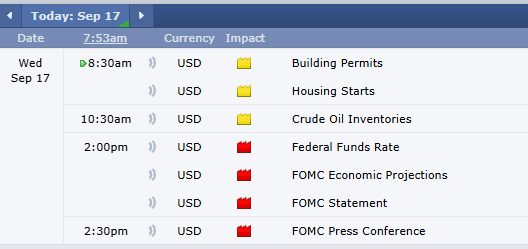

SCHEDULED NEWS

(I NEED YOUR HELP! PLEASE LIKE AND RESTACK!)

Good morning, everyone. Today is Wednesday, September 17th, and we have a huge day ahead of us. It is FOMC rate announcement day.

The rate decision will be released at 2:00 PM ET, but the real excitement comes at 2:30 PM ET when Fed Chair Powell gets on the mic. What he says about the economy and future rate cuts will be the biggest driver of volatility. To add to the complexity, we are in the middle of contract rollover, which makes volume extremely thin. The timing seems impeccable for a major shakeout.

Our 6594.50 4-hour level that I've been waiting on for two days played perfectly to the tick overnight, and now we sit and digest ahead of the news. Let's get into the levels.

A Trader's Warning on FOMC Day

Before we get to the levels, a heads-up: I personally do not trade FOMC. I will trade up until lunchtime and then turn my charts off. The moves are erratic, news- and algo-driven, and while you can sometimes get lucky, most of the time you don't. The risk is simply too high. My recommendation is to let the dust settle and come back tomorrow. The volatility can be enticing, but the warning has been put out there. Do as you must.

A Note on Contract Rollover

I have not rolled over yet. I am still trading the September (U) contract and will not be switching to the December (Z) contract until this coming Sunday for the Weekend Review.