S&P 500 Daily Trade Plan: Navigating News Uncertainty at All-Time Highs

A detailed ES futures trade plan for October 3rd, dealing with tentative news releases, a full day of Fed speak, and a critical gamma flip level at 6746.50.

SCHEDULED NEWS

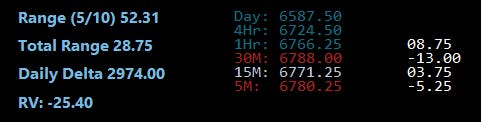

OPTIONS VOL LEVELS: ES/NQ

Good morning, everyone. Today is Friday, October 3rd.

Yesterday was a fantastic day for the plan. Price came down perfectly into our 6746.50 daily support, held, and then reclaimed 6752.00 just as we discussed. This triggered a classic failed breakdown and squeezed us all the way to new all-time highs. We were able to hold our targets for a fantastic 27-point long trade, and I know many of you in the room scored big on that one—congratulations to everyone who made it happen.

🧠 Current Market Context

Today’s environment is defined by uncertainty. We have a full schedule of Red Tag News, but due to the ongoing government shutdown, it is suspect whether the 8:30 AM numbers will actually be released. To complicate matters, we have a full day of Fed speak, with FOMC members on the horn all day long. We simply don’t know what will happen, so we must be prepared for volatility.

Interestingly, the relative volume is currently at -23%, which suggests we could have a bit of a snoozer of a day. However, that can change in an instant if market participants show up for the news or react to a headline from a Fed speaker. We have very little untested support nearby after wiping everything out on the move up, so we need to be patient and let price come to our defined zones.