S&P 500 Daily Trade Plan: Momentum Shifts to the Bears

A detailed ES & VIX plan for Feb 17th, breaking down the 6857 momentum shift, the VIX breakout at 21.77, and the 6751 liquidity sweep.

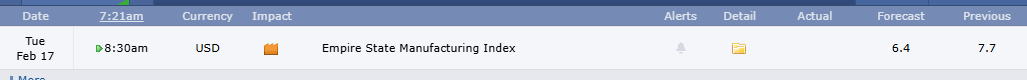

SCHEDULED NEWS

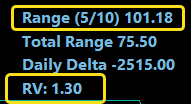

OPTIONS VOLITILITY LEVELS

Today is February 17th, it is Tuesday, and we are coming off of the President’s Day Holiday. We had an incredible last week and we received nothing but praises from our subscribers. We truly appreciate the support from each and every person who made last week count. The Monday holiday gave us an opportunity to put out the Weekend Review yesterday, which MANY people have viewed. If you haven’t checked it out, please do so this morning, as it is an in-depth and detailed look at exactly what is going to happen from a bigger-picture perspective.

A Note on Today’s Market:

News: No Red Tag news to speak of today.

Volume: Relative Volume is flat on the day.

Range: Projected range of 100 points. We have moved approximately 65 points in the overnight session (bringing us down 29 points), leaving us 40 points above or below the overnight high or low.

Gamma: We are in Negative Gamma territory. Fear is starting to take over, and more than likely we will have a large range with money made in both directions.

Trend: Down. We have lost on the Daily, Weekly, and 4-Hour timeframes. The Bears have the upper hand.

🧠 Current Market Context

The Bearish Shift

Last night, the Globex price action drifted lower in the overnight session. We are currently still looking for more downside as we have lost on the Daily, Weekly, and 4-Hour timeframes. We have some major levels that we look to play Above or Below that shift momentum in the favor of the Bears or Bulls, but the Bears have the upper hand as of now. The Bulls have a lot to accomplish to actually shift momentum in their favor completely.