S&P 500 Daily Trade Plan: Market Coils at Highs with 80+ Points Left in the Tank

A detailed ES futures trade plan for October 21st, breaking down the critical 6761.75 pivot and the ultimate 6750.25 line in the sand for intraday bias.

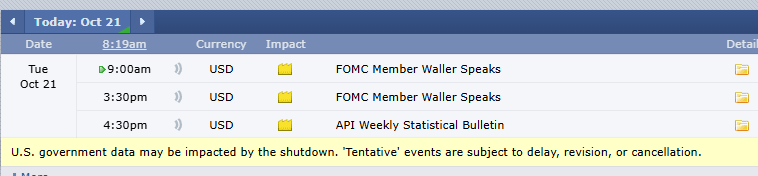

SCHEDULED NEWS

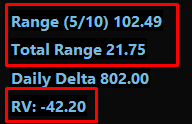

OPTIONS VOL LEVELS

Good morning, everyone. It’s Tuesday, October 21st.

Yesterday was an insane push. We gapped up above our monster make-or-break level of 6732.00, came back to tap it from the backside, and then propelled up 78 points. It was a low-volume and slightly painful grind, but if you were able to stay in the long, it was quite fruitful.

🧠 Current Market Context

As we sit up here in balance, we have to ask what’s in store for today. The relative volume is extremely low at -41%, but the 5-10 day average range is a massive 102.5 points. We’ve only moved 21 points overnight, which means we technically still have 80 points left in the tank one way or the other. Even if we reduce that for the low volume, it’s still a 60-point day, meaning a 40-point move from here is easily possible.

The market is coiled for a tight move, and my radar is up. On low-volume days like this, we do not want to fade the trend unless we have an absolute, concrete reason to. The plan is to stick to our pivots.