S&P 500 Daily Trade Plan: Market Coils at Highs, Defaulting to Trend

A detailed ES futures trade plan for October 22nd, focusing on the critical 6761.75 pivot and a high-probability “sweep and reclaim” setup at 6750.25.

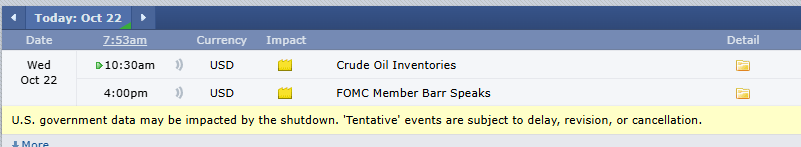

SCHEDULED NEWS

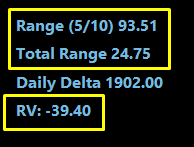

OPTIONS VOL LEVELS

Good morning, everyone. It’s Wednesday, October 22nd.

Yesterday, the market balanced in a range above our significant weekly level at 6761.00 and found major resistance at the 6791.00 weekly POC, just as we called out in the weekend review. As of now, that resistance area has been highly tested. We are currently in a pivotal spot, accepting value inside a two-day range and also inside the massive range from the beginning of October.

🧠 Current Market Context

We are coiling for a move. The expected range for today is 93 points, but we’ve only moved 24 points overnight. With relative volume at a very low -39%, we could continue to grind higher. On low-volume days like this, especially near all-time highs, we must default to the trend. The 4-hour has gained, the daily has gained, and we are pointed up. Price is currently sitting dead in the middle of Monday’s and Tuesday’s range, which means we are building energy for the next move.