S&P 500 Daily Trade Plan: Key Structure Breaks as Volatility Spikes

A detailed ES futures trade plan for October 14th, focusing on a high-probability short setup at the broken 6660.00 leg and navigating extreme volatility with Powell on the mic.

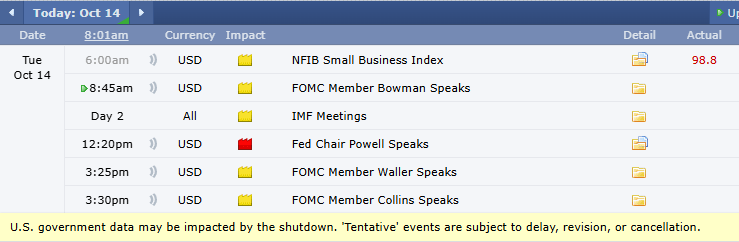

SCHEDULED NEWS

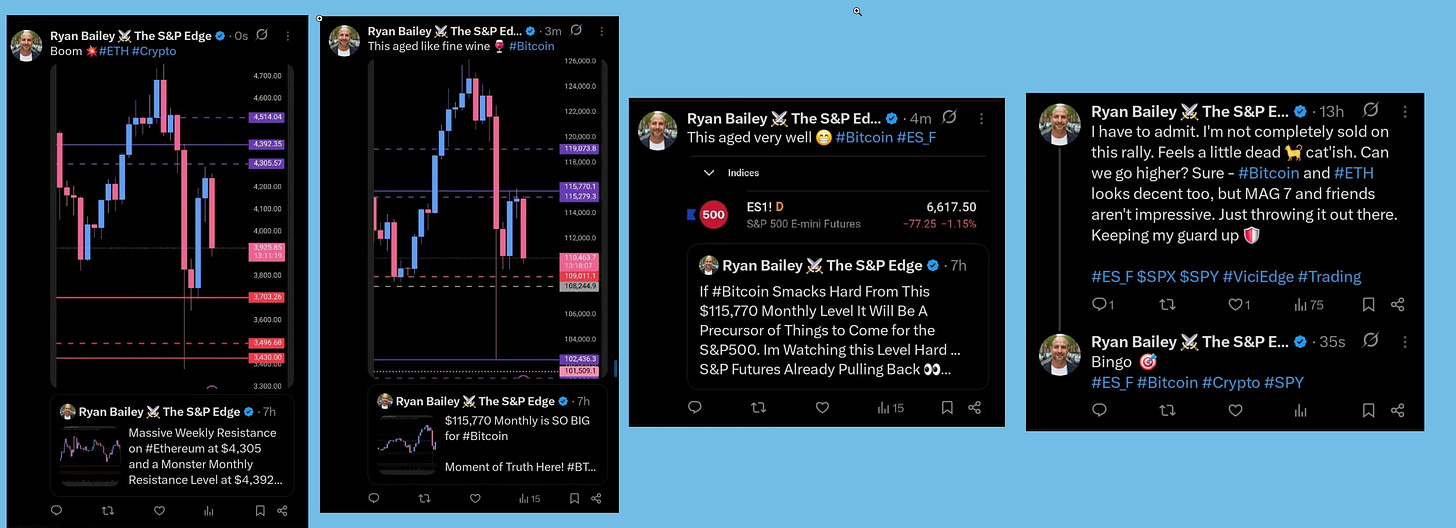

Yesterdays X Callouts:

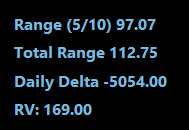

RANGE STATS:

OPTIONS VOL LEVELS

Good morning, everyone. It’s Tuesday, October 14th, and we have had quite an evening.

First, if you are not following me on Twitter, you are missing out. Every single thing I posted yesterday has come to fruition so far—we are batting 100%. Give me a follow at @RyanBaileyEdge. It doesn’t cost you a thing, and you might make some money.

Yesterday’s insane 100-point pop was a classic dead cat bounce, just as we anticipated based on the VIX statistic from the weekend. Price was perfectly contained, bumping its head on our major 6706.75 resistance while the daily leg at 6660.00 held as support overnight. However, that structure has now failed.

🧠 Current Market Context

I was watching Bitcoin last night, and as it failed to hold a key monthly level, I posted that we would likely see significant downside in the indices. We woke up this morning with the ES down 75 points. We have now lost and are trading well underneath the significant daily leg at 6660.00, which is a major structural change.

This is a very fragile market. With Fed Chair Powell on the mic at 12:20 PM today, any little thing could tip the bucket. The volatility is extremely high, with relative volume at 166% and the daily range already exceeded. Do not guess today—wait for your levels.