S&P 500 Daily Trade Plan: High-Volume Balance After Hitting Weekly Target

A detailed ES futures trade plan for October 30th, navigating a post-FOMC balance, key overhead resistance at 6948.00, and multiple “sweep and reclaim” support setups.

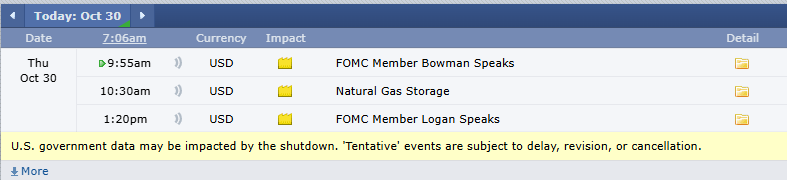

Scheduled News:

Good morning, everyone. It’s Thursday, October 30th.

If you followed the plan yesterday, you absolutely crushed it. We called the high of the day to the tick at 6952.00, which was a flawless short setup that took us all the way down to our target at the 6882.75 1-hour level. That level held all afternoon and into last night, fueling a push to a new Globex all-time high.

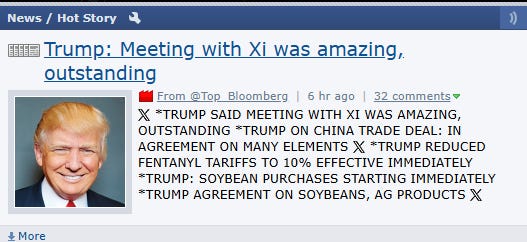

The FOMC announcement yesterday gave the bulls more gas, cutting rates a quarter-point and keeping this market on fire. This was followed by news that President Trump and China’s President Xi reached an agreement for only 10% tariffs, another significant tailwind. As I covered in an article yesterday (which I’ll link here), when the Fed has cut rates at all-time highs (only five times in history), the S&P has seen an average 20% increase within one year.

🧠 Current Market Context

We are still bullish, but we’ve now hit our weekly extension target of 6950.00. Despite this, the market gives the perception that ling term it still has gas in the tank, and yesterday’s TPO profile left a poor, inefficient high that needs to be repaired as well as a new ATH in the overnight Globex session that will be a target for the Cash Session bulls moving forward. We’re currently sitting in a massive 3-day balance area, and post FOMC volatility has wiped most of our levels during its volatile move making it difficult to pick a direction. We have to default to the trend (up), but be aware that this market feels fadeable.

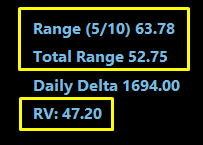

Relative volume is up substantially at +47%, which is a lot of participation. The expected range is 63.75 points, and we’ve already moved 52.75 points overnight, so we’re close to our expected move, though high volume could easily extend this.