S&P 500 Daily Trade Plan: Grinding Higher in Price Discovery Mode

A detailed ES futures trade plan for October 28th, focusing on key sweep-and-reclaim setups as the market targets the 6950.50 weekly imbalance.

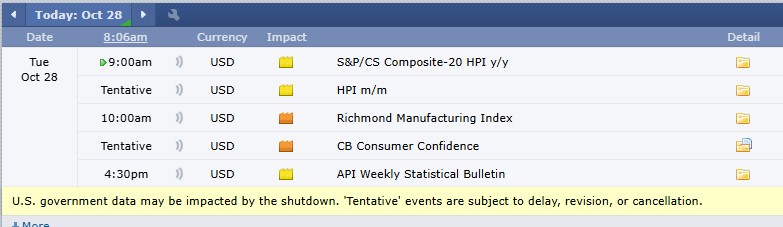

Scheduled News:

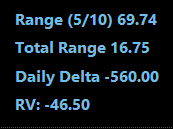

Options VOL Levels:

Good morning, everyone. It’s Tuesday, October 28th.

Yesterday was an interesting day. We gapped up higher on the China news and continued to drift higher all cash session, making it very difficult for buyers to get on board. After rallying into the close, the market seems to have done the same thing again overnight – barely pulling back 10 points, riding the weekly one standard deviation VWAP as support, and pushing higher again in the pre-market as we continue surfing all-time highs.

🧠 Current Market Context

This makes for an extremely difficult trading situation. Price discovery gives us no upside resistance, and as we move higher, support becomes thin. We are currently seeing very low relative volume at -46%. As we’ve discussed many times, when the trend is up and volume is low, we defer to the trend as we will more than likely continue to grind in that direction. The structure is extremely bullish. Our ultimate target remains the massive weekly bullish imbalance up at 6950.50, and we are getting very close – only about 30 points away. It’s possible we find ourselves up there this week, maybe even today.