S&P 500 Daily Trade Plan: FOMC Volatility & The All-Time High Chase

A detailed ES & VIX plan for Jan 28th, breaking down the 7042 Call Wall, the 7016.50 Support Flip, and the FOMC Strategy.

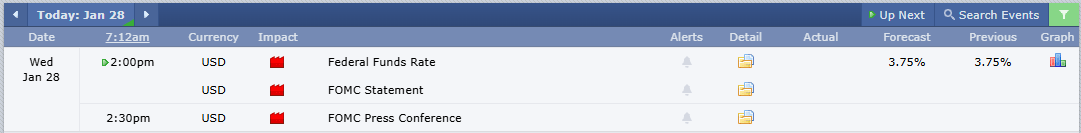

Scheduled News

Options Volatility Levels

Morning everyone. Today is January 28th, it is Wednesday. We had an insane day yesterday. We called the low at 6989.00, we called the high reversal at 7016.50 after SPX made new All-Time Highs, and then we called the buy in the middle at 7002.25. Yesterday was an insane day for our trade plan members and members of our Discord Community, as we essentially caught every single turn of the market and our profit and loss showed it.

As we come into the morning, we have now had our push up all the way through All-Time Highs as predicted in the post-market breakdown, and we have bumped our head on a massive Call Wall at 7042.00. We have FOMC today at 2:00 PM, which will without a doubt bring intense volatility. As we sit at All-Time Highs, we’re just hanging out waiting for J-Pow to make a decision. What moves the market is the statement at 2:30 PM and his forward guidance—that is where the real news comes into play.

A Note on Today’s Market:

News: FOMC Announcement at 2:00 PM EST and Press Conference at 2:30 PM EST.

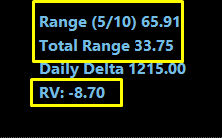

Volume: Relative Volume is -7% for now, but that will change once Powell starts speaking.

Range: Potential range of 66 points. We have moved 33.75 points in the overnight, leaving 31 points left in the tank. Note: With FOMC, these numbers are just a guide.

Trend: The trend is Up. This is a “Buy the Dip” day.

🧠 Current Market Context

The All-Time High Target & Call Walls

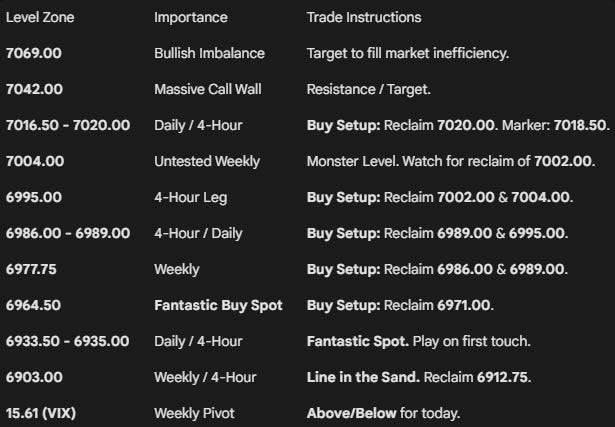

Right now, for resistance, we have none as we are sitting above the last level of major support and the overnight session hit the All-Time High above us. We do have some targets:

Call Walls: 7042.00, 7062.00, and 7072.00.

Bullish Imbalance: Large imbalance from two weeks ago that could take us to 7069.00 to fill the market inefficiency. Look for this to possibly get filled today during FOMC.

The Overnight High Rule: We made a new All-Time High in the overnight session. This will never stand for the cash session; they will be seeking to fix this. New All-Time Highs from the overnight will be our Target for today.

🚨 VIX Analysis: The 15.61 Pivot

VIX has held the support at 15.68 and is currently moved into our weekly pivot at 15.61.

The Pivot: 15.61 (Weekly). We will use this as our Above/Below for today.

Headwind: If we push above 15.61, we may have a slight headwind. VIX could push into the major pivot at the Monthly 17.44 and Untested Daily at 17.62. A break above this could squeeze hard to the Untested Daily at 20.09 and Weekly at 20.38, causing indices to fall rapidly.

Tailwind: If they stay underneath the 16.51 Weekly pivot (and 15.61), we will continue to drift higher and potentially push lower on VIX to the Major Daily Support at 15.41.

Breakdown: If VIX breaks 15.41, the indices will have no choice but to continue to traverse All-Time Highs in price discovery mode.

🎯 Detailed Actionable Trade Plan (ES Futures)

My suggestion is to trade until FOMC, play the levels, stick to the plan, and then sit out FOMC.

🔴 Key Resistance Zones & Setups

Call Wall Cluster: 7042.00 - 7072.00

7042.00 (Massive Call Wall), 7062.00, 7072.00 (Final Call Wall).

Context: These are our upside targets.

Actionable Setup: Look for the Bullish Imbalance at 7069.00 to potentially fill.

🔵 Key Support Zones & Setups

Immediate Support Zone: 7013.25 - 7020.00

7020.00 (4-Hour), 7022.00 (Options Pivot), 7016.50 (Daily), 7013.25 (1-Hour / Yesterday’s POC).

Context: 7016.50 was yesterday’s highest resistance; now likely support.

Actionable Setup: Look for 7016.50 to play and get back above the 7020.00 4-Hour to prove buyers have stepped in. Use Yesterday’s High at 7018.50 as a marker.

Untested Weekly & VWAP: 6991.75 - 7004.00

7004.00 (Untested Weekly), 6995.00 (4-Hour / 1-Hour Leg to High), 6991.75 (Weekly VWAP).

Context: 7004.00 has been a monster level.

Actionable Setup: I see 6995.00 playing. We want to see it reclaim the significant 4-Hour at 7002.00 and get back above 7004.00. Take profits around 7016.00.

Untested 4-Hour & Daily: 6986.00 - 6989.00

6986.00 (Untested 4-Hour), 6989.00 (Daily).

Actionable Setup: Not my favorite, but if 6986.00 plays, look for it to get back above 6989.00 and 6995.00 for continuation.

Significant Weekly: 6977.75

6977.75 (Significant Weekly).

Actionable Setup: Played multiple times. To ensure this trade goes, we want to see it play and get back above 6986.00 and importantly 6989.00. Could squeeze nicely.

Fantastic Buy Spot: 6964.50 - 6966.75

6964.50 (Daily), 6966.75 (4-Hour), 6966.25 (Prev Weekly VAH), 6971.00 (Put Wall).

Actionable Setup: Fantastic buy spot. Look for continuation back above 6971.00 and ultimately 6977.75.

Daily / 4-Hour Combo: 6933.50 - 6935.00

6935.00 (Daily), 6933.50 (4-Hour).

Actionable Setup: Fantastic spot. Play on first touch. Look to take profits around 6957.00 and 6964.00.

The Line in the Sand: 6903.00 - 6904.00

6904.00 (4-Hour Leg to High), 6903.00 (Significant Weekly).

Context: Last untested Weekly leg to the All-Time High.

Actionable Setup: Want to see this play and get back above 6912.75 to trigger our squeeze.

Below this things can get ugly fast.

📌 Cheat Sheet – Key Levels Recap

🧠 Final Thoughts

My suggestion to you guys is trade until FOMC, play the levels, stick to the plan, and then sit out FOMC. The news is extremely volatile, and while our levels will get respect, we never know which ones they might blow through to get to the one that works.

I have always lost more money trading FOMC than I’ve made over the years. It is very beneficial to simply trade the morning and take the afternoon off. Go out and touch the grass (or snow). Let the dust settle, and tomorrow we can easily pick back up where we left off. This plan is straightforward: We are buying the dips until we break the 6903.00 Weekly.

Until next time—trade smart, stay prepared, and together we will conquer these markets!

Ryan Bailey, VICI Trading Solutions.