S&P 500 Daily Trade Plan: Downside Continuation & The 6964.50 Pivot

A detailed ES plan for Feb 11th, breaking down the 7004.50 rejection, the 6964.50 barometer, and the “Curtains” level at 6938.00.

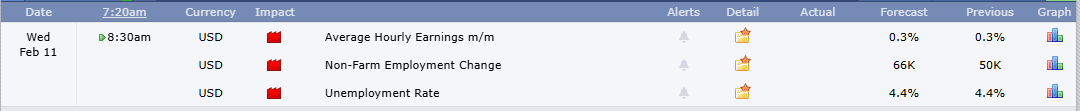

SCHEDULED NEWS

OPTIONS VOLITILITY LEVELS

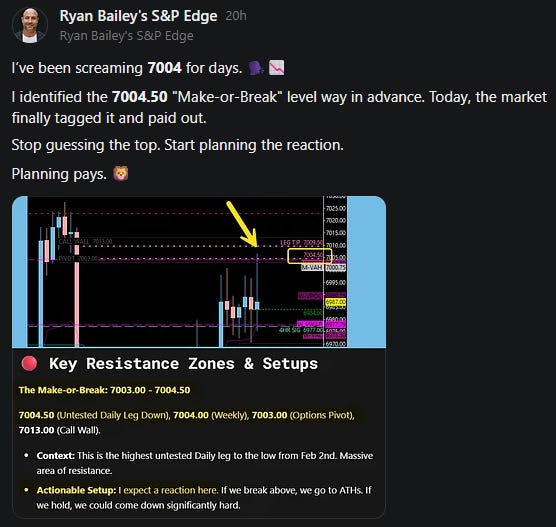

Today is February 11th. We are coming off another ridiculous trade plan yesterday where we called the very top at 7004.50, which brought us down all day for a total of over 45 points. We are still getting this continuation downside to the overnight session after calling the exact short at 6985.00 in the Post-Market Breakdown. We are just absolutely on fire—congratulations to all those who took advantage of these opportunities.

A Note on Today’s Market:

News: 8:30 AM Non-Farm Payrolls, Unemployment Rate, Hourly Earnings (Red Tag). Guaranteed to be a big news report; sticking to the plan is vital.

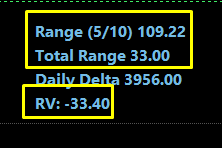

Volume: Relative Volume is Low at -31%.

Range: Expected range of 110 points. We have moved 33 points, leaving approximately 50 to 60 points left in the tank.

Gamma: We are in Negative Gamma (Flip at ATH). Expect extreme volatility.

Trend: Leaning Downside. We have not gained on the Daily timeframe and lost support on the 4-Hour yesterday.

🧠 Current Market Context

The 7004.50 Rejection

The area that we came off of at 7004.00 was an extreme spot that could potentially lead us more down. We are in a position right now where we are going to “Make It or Break It.”

The Barometer: 6964.50

6964.50 has been our significant pivot for some time and should be used as a significant barometer today. I am still very much feeling like we could continue to push lower as under our current location support is very thin.