S&P 500 Daily Trade Plan: Deferring to an “Unfadable” Trend at Key Resistance

A detailed ES futures trade plan for October 31st, navigating the critical 6918.25 pivot after a post-earnings squeeze, with key support levels defined.

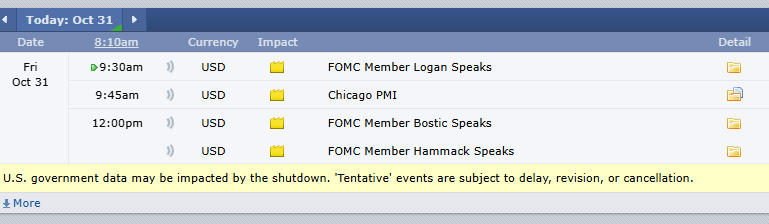

Scheduled News:

Options VOL Levels:

Good morning, everyone. It’s Friday, October 31st.

First, I want to apologize for the late release of the trade plan. I had some internet issues this morning, and it’s been a long morning, so let’s get right into it.

Yesterday, our trade plan was on fire. We had the high, the low, and the middle of the day, and for those subscribers, we really did a fantastic job. We covered it all in the post-market breakdown (I’ll leave the link below). Congratulations to everyone who took advantage of all the opportunities.

Now, it’s time to do it again. Price pushed down to fill the half-gap and then popped after-hours on Apple’s earnings, just as our plan suggested. We reclaimed the 6870.00 area and have squeezed all night, pushing us right into our major resistance at 6918.25.

🧠 Current Market Context

We are currently up 58 points and right back in the middle of the 5-day balance, which makes picking a direction difficult. However, we know we have a previous Globex all-time high as a target, a bullish imbalance from Wednesday, and a weekly bullish imbalance. There are a lot of reasons to believe we can move higher. Given the up move, we have to defer to the trend, as this market seems unfadable.

Relative volume is low at -23%, and the expected range is 62 points. We’ve already moved 30 points, leaving approximately 30 points left in the tank.