S&P 500 Daily Trade Plan: Deferring to Trend into CPI News

A detailed ES futures trade plan for October 24th, focusing on key reclaim setups and the critical new daily leg support at 6738.75 amidst low volume.

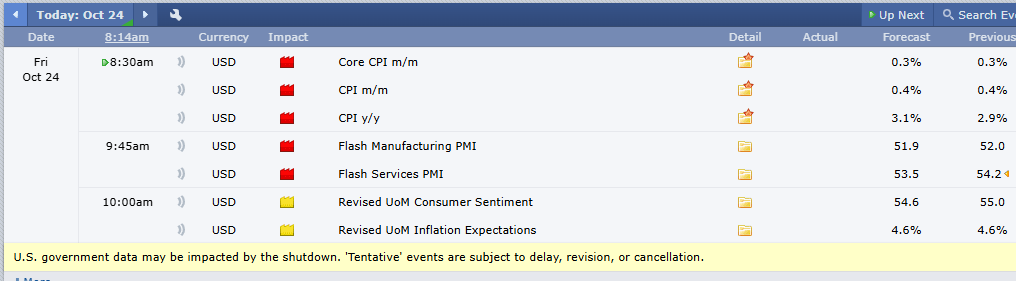

SCHEDULED NEWS

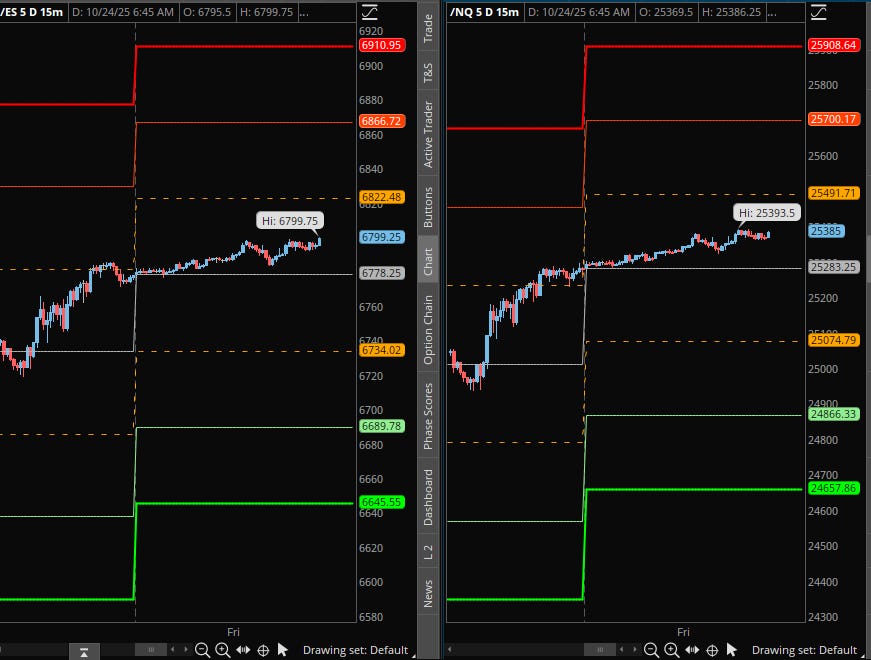

OPTIONS VOL LEVELS

Good morning, everyone. It’s Friday, October 24th.

We actually have Red Tag News this morning for the first time in a month! Core CPI hits at 8:30 AM pre-market, so be prepared for a shake. Other potential news includes Flash Manufacturing PMI (9:45 AM) and Revised Consumer Sentiment (10:00 AM), but those are less certain due to the ongoing shutdown.

Yesterday was pretty incredible. Our bias shifted bullish pre-open when price opened above 6732.00, and the market immediately propelled higher all day, pushing up 70 points. The daily gained, and so did the 4-hour, confirming the uptrend.

🧠 Current Market Context

We are continuing to push higher in the overnight session and are up 20+ points as we approach the CPI release. The trend remains up, signs are pointing higher, and the VIX is extremely low, providing a tailwind. Don’t forget, we have a daily bullish imbalance that takes us up to 6812.00, which is essentially new all-time highs, and a weekly bullish imbalance that takes us all the way up to 6950.00.

However, relative volume is very low again (-46%), suggesting a potential grind. The expected range is 75 points, with about 50 points still left in the tank. With low volume but high-impact news, anything can happen. We simply defer to the trend and continue to look for longs at key levels.