S&P 500 Daily Trade Plan: Critical Structure Test at the 6738.75 Pivot

A detailed ES futures trade plan for November 7th, analyzing the critical 6738.75 daily leg, which has now flipped to resistance, and defining the key support zones below.

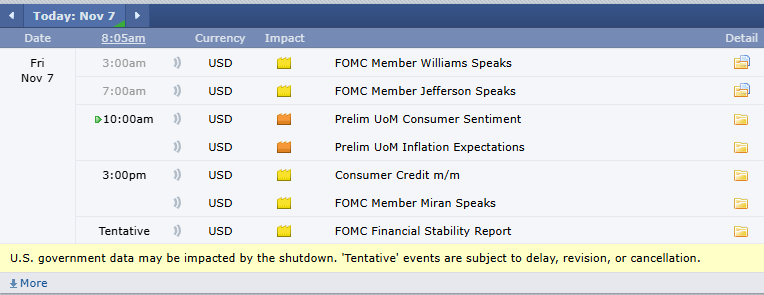

Scheduled News:

Options VOL Levels:

Good morning, everyone. It’s Friday, November 7th.

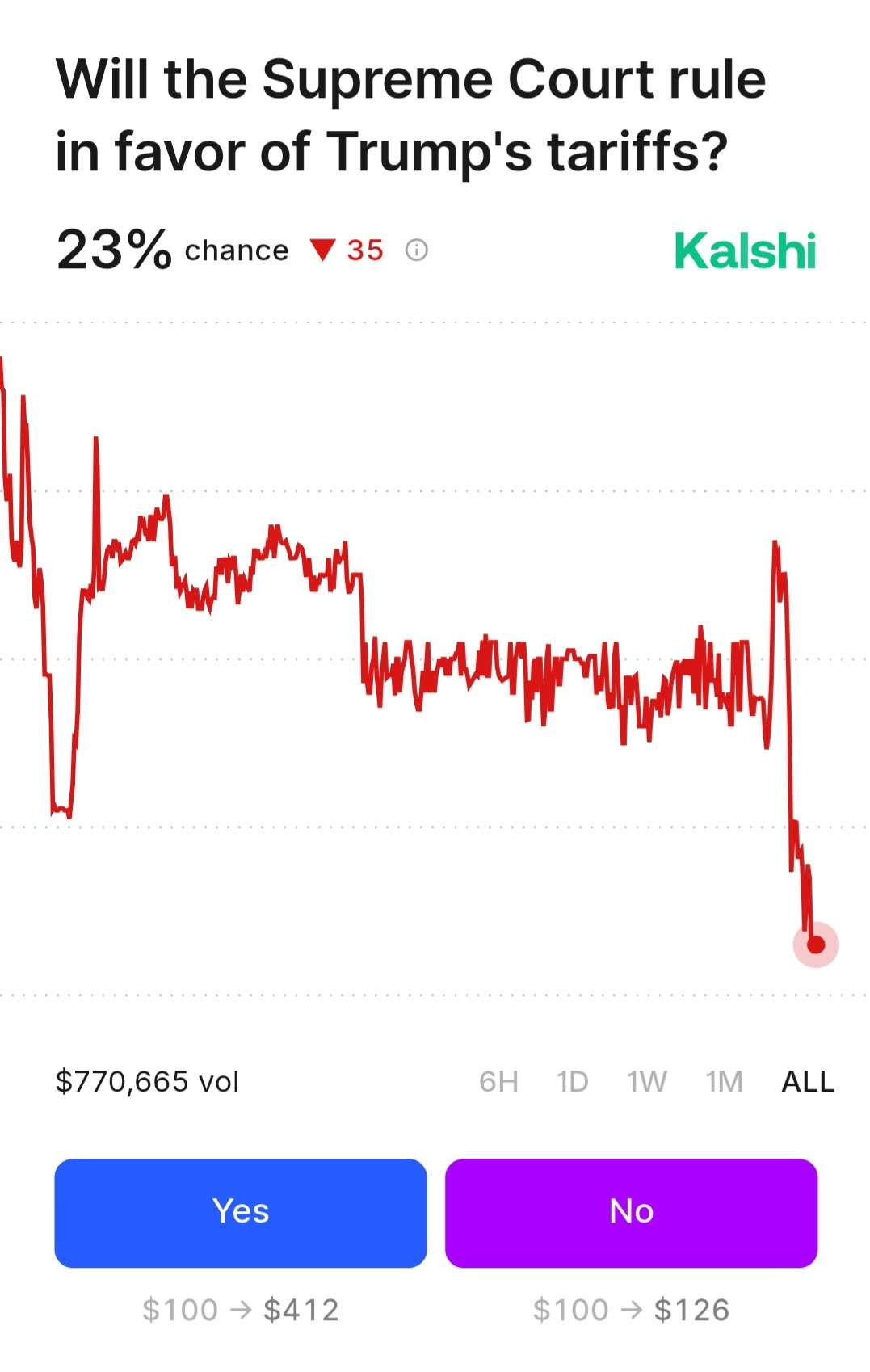

Yesterday was a hell of a day. The sell-off was driven by news and fears surrounding the Supreme Court’s tariff ruling, and it pushed price right down into our major daily leg at 6738.00, which played for a beautiful 50-point pop. However, the market continues to sell off.

🧠 Current Market Context

The market does not like uncertainty, and the Supreme Court ruling is not looking favorable for Trump (prediction markets are giving it <25% chance of passing). This uncertainty has caused a critical shift.

As I spoke about in yesterday’s post-market stream, our daily leg at 6738.75 was the key level for bulls to hold. We have currently drifted below this, and it looks as if we will open below it. If we do, this level flips from “serious support” to “serious resistance,” and we must adjust our bias. The bulls truly need to open above and hold 6738.75 to maintain upside progression. An open below is bearish.