S&P 500 Daily Trade Plan: CPI Volatility & The 6815.75 Last Stand

A detailed ES & VIX plan for Friday the 13th, breaking down the 6857 Monthly Pivot, the CPI print, and the sweep target below 6750.

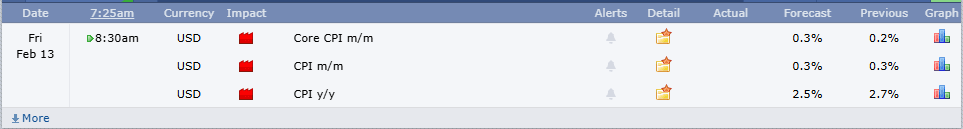

SCHEDULED NEWS

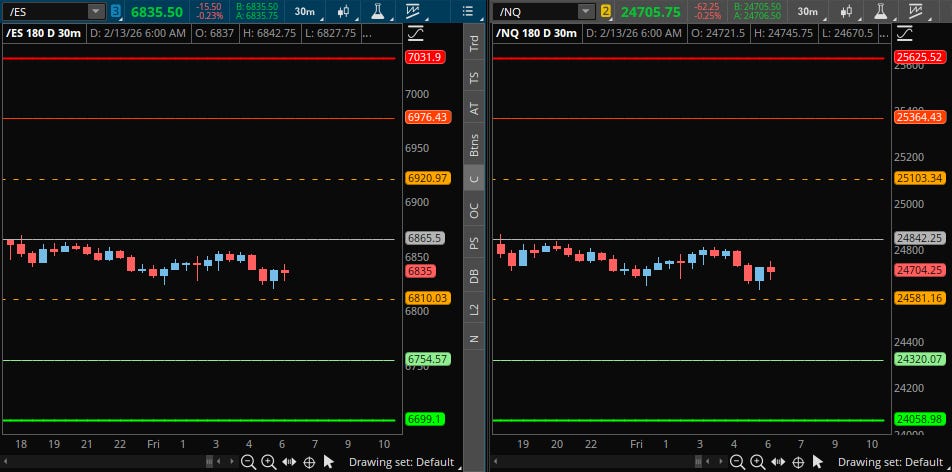

OPTIONS VOLITILITY LEVELS

Today is February 13th. Friday the 13th. (Spooky) We had an insane day once again in the trade plans, calling the high at 6989.75 Daily and ultimately the upper range at 6995.00. We also pegged it perfectly for our SPX Traders, leading us down well over 100 points. This was a pre-planned short that we’ve been waiting for since Monday and it finally paid dividends. Congratulations to everyone who took advantage of this, as yesterday was the type of day that months and careers are made.

A Note on Today’s Market:

News: 8:30 AM CPI (Red Tag). This is a massive inflation number and guaranteed to give us a shake. It will be a huge determining factor for the sustained move for the rest of the day.

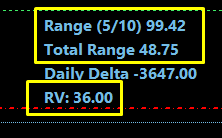

Volume: Relative Volume is elevated at 28%.

Range: Expected range of 100 points. We have done a total range of 48 points in the overnight, leading us to believe we could have approximately 70 points left in the tank.

Gamma: We are still underneath Negative Gamma. Dealers are hedging to the short side. This does not mean Longs will not play; squeezes will ensue and lots of money will be made in both directions.

Trend: Down. We have not gained on the Daily timeframe and have lost on the 4-Hour timeframe. Momentum is to the downside.

🧠 Current Market Context

Overnight Weakness:

Last night in the overnight session, we stayed well underneath our significant Monthly at 6857.25, which is our massive lower-end momentum shift pivot. Price has stayed underneath this as it continued to drift lower. We are currently sitting at our very important, significant, and untested Daily support (6815.75).

SPX Structure:

SPX closed in a very significant area—the spot that was gained and never tested at 6834.50. We need to be very aware of this spot at the open. As long as they stay contained below the 6845.00 Weekly and ultimately the massive pivot at 6834.50, price will continue to move lower.