S&P 500 Daily Trade Plan: Buying the Dip in a “Serious Support” Zone

A detailed ES futures trade plan for November 4th, focusing on key “sweep and reclaim” long setups as the market drops into a massive high-timeframe support cluster.

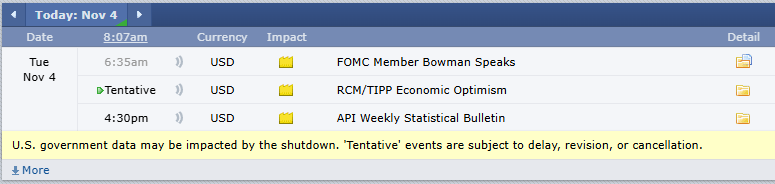

Scheduled News:

Options VOL Levels:

Good morning, everyone. It’s Tuesday, November 4th.

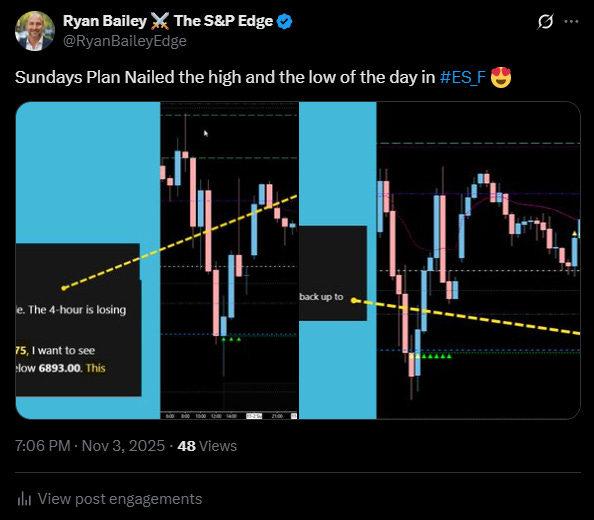

What a killer day we had yesterday. We called the top short, the bottom long, and the midday short—a fantastic day for our subscribers.

We have finally fallen and come down into the major support area we discussed all weekend. The headlines are blaming the Supreme Court and Trump’s tariffs for the move, but we know from a technical perspective we were able to call this on Sunday.

🧠 Current Market Context

Even though we’re coming down, this is not the time to be bearish. We slid 100 points in the overnight session and are opening down 76 points, but we are now in serious support. We have filled the weekly TPO gap down to 6790.00 almost perfectly and are resting on the 20-day moving average, inside the 10/5 weekly value area, and at the 10/19 value area high.

Relative volume is extremely high at +109%, and we’ve already hit 97 points of range. While we may get a bit more down, I personally will not be looking for shorts today. I believe the long will pay better than the short given our current location.