S&P 500 Daily Trade Plan: Accepting Value at Highs with a Clear Line in the Sand

A detailed ES futures trade plan for October 9th, focusing on a key failed breakdown setup at 6795.25 and the critical 6788.00 intraday bearish pivot.

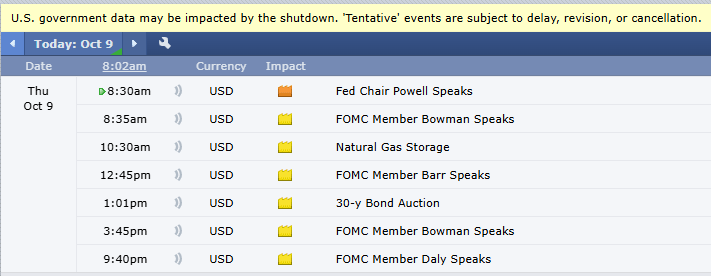

SCHEDULED NEWS

OPTIONS VOL LEVELS

Good morning, everyone. It’s Thursday, October 9th.

With the government shutdown ongoing, we once again have no Red Tag News events on the calendar. However, we need to be aware that Fed Chair Powell speaks at 8:30 AM, and there is other Fed speak scheduled throughout the day that could cause some gyration.

Yesterday was an insane day. We saw an incredible push up that retraced the entire move down from Tuesday. Price accumulated above the 6758.00 4-hour leg all night, which ultimately pushed us back toward all-time highs. Now, as we’ve settled in overnight, price has accepted value and is using the significant 4-hour level at 6795.25 as support. While it looks like we are pointing higher, we have very clear lines in the sand to watch.

🧠 Current Market Context

As price held all night above our significant 4-hour at 6795.25, it appears we are starting to accept value in this higher range. This suggests we are likely to continue making a push higher toward our ultimate upside target, the weekly bullish imbalance up at 6825.75. However, the market has also set up a beautiful trade for us if sellers decide to step in. The day’s bias hinges on a critical pivot at 6788.00. Above it, we look for longs; below it, the script flips to intraday bearish.