S&P 500 Daily Trade Plan: A Precarious Position After First Daily Loss

With Core PCE on Deck, Here’s How to Trade the Pivots and the ‘Excellent’ Long Setup at 6588.50.

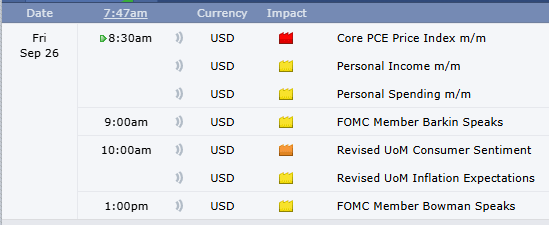

SCHEDULED NEWS

Good morning, everyone. Today is Friday, September 26th, and we are in the middle of a precarious position.

Yesterday, the ES sold off underneath our daily level at 6664.00 and came very close to filling in our weekly excess before reversing back to our significant daily pivot at 6673.00, only to turn around and make another low. Price has been moving sideways all night, holding above our significant 4-hour leg-end at 6651.75 and flirting with our daily leg at 6664.50.

We have Core PCE news coming in at 8:30 AM, so we need to be prepared for anything. Let’s take a look at the levels.

🧠 Current Market Context

We have some interesting and conflicting signals this morning. For the first time in quite some time, we have finally shown weakness on the Daily timeframe, with a close below our daily leg at 6664.50. What’s interesting, however, is that while SPY also confirms this loss, SPX (the boss) did not lose its leg. This means we need to be extremely careful, as price can go both ways. My ultimate concern is that this whole section was involved in rollover, so the pricing is not exact, and I proceed with caution. The market has inefficiencies on both sides, with weekly singles up to 6680.00 and excess in the profile down to 6513.00.