S&P 500 Daily Trade Plan: A Make-or-Break Spot After a Monster Reversal

A detailed ES futures trade plan for October 16th, focusing on the critical 6706.75 intraday pivot and a major re-test of the 6767.00 resistance where the market collapsed.

SCHEDULED NEWS

OPTIONS VOL LEVELS

Good morning, everyone. It’s Thursday, October 16th.

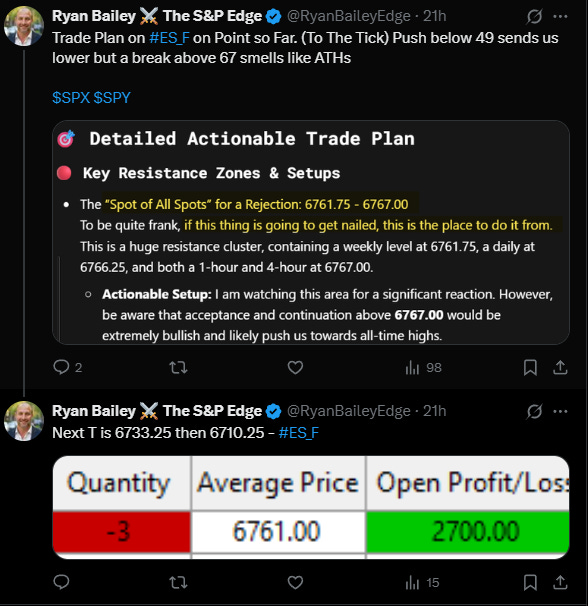

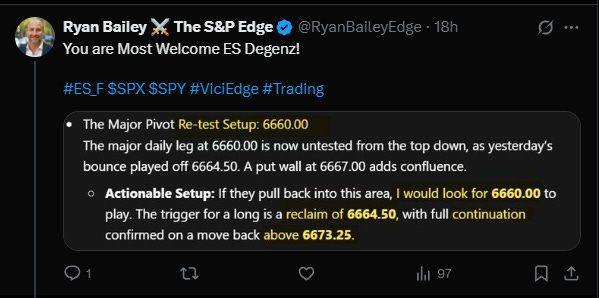

Yesterday was an absolutely insane day. We saw a monster range of over 100 points, and our plan played out amazingly. It’s impossible to cover all the winning trades, but two highlights stand out: the high-tick short at our 6767.00 major resistance which played out for a fabulous 110-point drop, and the long at the lows on the reclaim of 6660.00, which pushed us right back up for 90 points and counting.

🧠 Current Market Context

After yesterday’s massive smackdown from the highs, the bears failed to make new lows, and the bulls managed to retrace almost the entire move. We have to assume the trend will continue up. However, we are in a very precarious position. With Fed speakers on the horn all morning, and with price now at the upper end of yesterday’s value, we are at a true make-or-break spot.

The daily TPO profile tells a clear story of two-sided inefficiency. We have single prints that still need to be repaired on the upside all the way to 6782.00, which presents an excellent target. However, we also have downside single prints to 6638.00, which lines up perfectly with a key daily support level. The market could go either way from here, so we lean into our levels.