S&P 500 Daily Trade Plan: A Battle at the High-Probability Bounce Zone

With Price Testing the Key 6431.75 Pivot, Here's How to Trade the New Daily Leg at 6413.25 and the Warning Signs from the VIX.

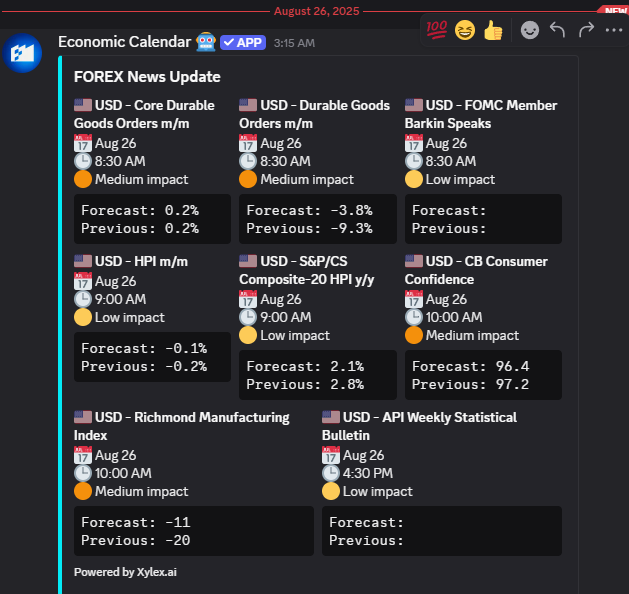

Scheduled News:

Good morning, everyone. Today is Tuesday, August 26th.

Our premonition from yesterday came true. After holding the 6462.00 level on extremely low volume, the market failed to find any further continuation and rolled over. My pre-market concern about a further down move was warranted, but the good news is that we have now arrived in what I would consider our high-probability pocket for a potential bounce.

We have no red-tag news this morning, but we do have a slate of events that could cause a shake, including Core Durable Goods pre-market and Consumer Confidence at 10:00 AM ET. Price drifted down pretty heavily overnight and came directly into our significant daily at 6431.75, cleaning up the single prints from Friday just as we predicted.

Now, let's look at the intermarket signals and get into the levels.