SCHEDULED NEWS:

Welcome back. It is Sunday, September 14th, and it's time for the Week in Review for the Nasdaq (NQ) futures. After almost six months of green, let's see what we've got going on.

The big event this week is the FOMC announcement on Wednesday. The real question is whether they cut rates by 25 or 50 basis points. A 50bps cut, and we go to the moon. Otherwise, Monday and Friday are expected to be snoozers, with the market likely waiting for Wednesday's catalyst.

🧠 Current Market Context

The NQ has been on an incredible run, but this has created a precarious situation. As we've trended up hard, nearly every level of support has been back-tested on the way up. This leaves the support structure looking pretty thin and, frankly, a bit grim.

The entire market structure is currently balancing on a single, critical, untested high-timeframe level. If that level fails, it gets nasty to the downside, real quick. So, while the trend is up, we must be extremely careful and lean on our levels and setups.

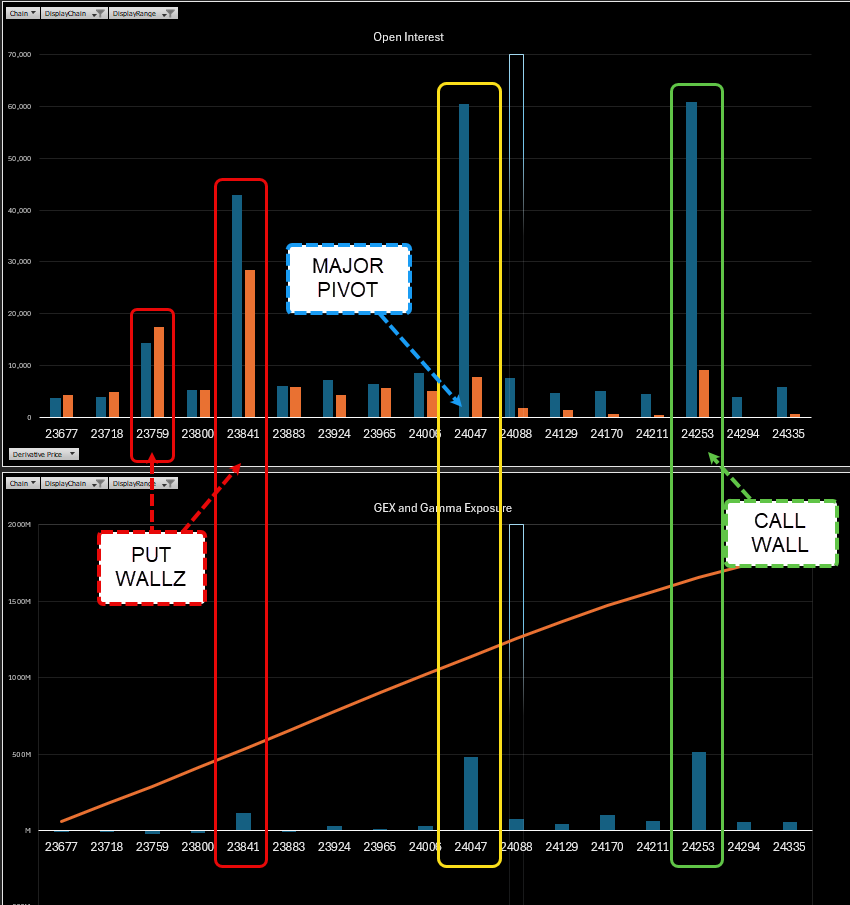

📈 VICI Options Analyzer Note

The options market is providing massive confluence to our key pivot. There is a huge amount of gamma and calls located at 24,047.00. This aligns almost perfectly with our daily level. This tells us two things: the level is technically untested from the top down which is great for a potential buy, but if we get underneath it, the unwinding of those calls could fuel a very nice sell-off.

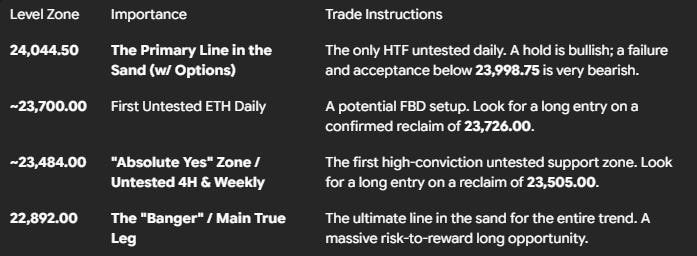

🎯 Detailed Actionable Trade Plan

🔴 Key Resistance & Upside Targets

With the market at all-time highs, there is no technical resistance. The focus is on the key pivot below us.

🔵 Key Support Zones & Setups

The Primary Pivot: 24,044.50

This is it. This is the only high-timeframe untested daily level I have until we get much, much lower. It's also Thursday's high of the day. How the market reacts here will dictate the week. If this level doesn't hold and we get below the heavily tested daily at 23,998.75, look out below.

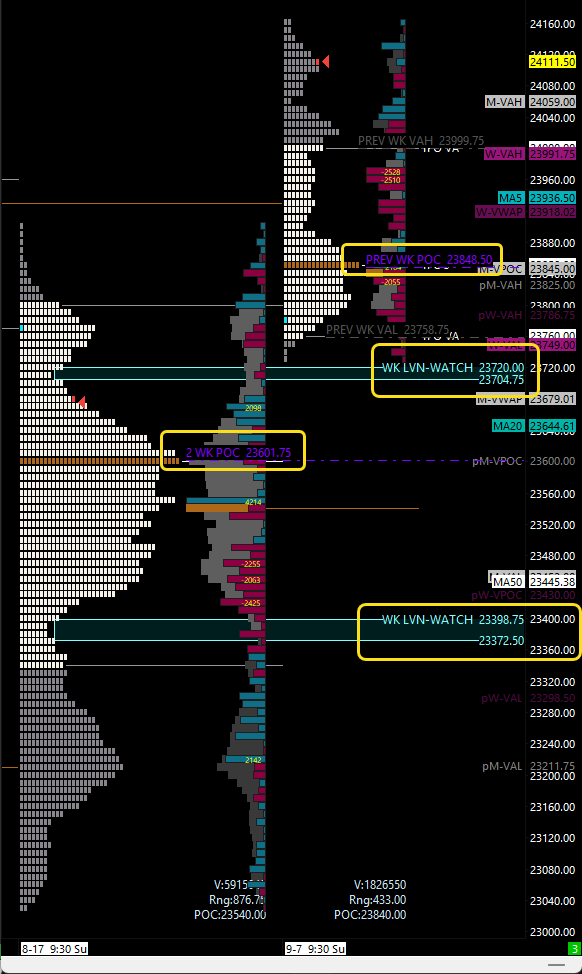

The "Fishing for a Trade" FBDs

Because there is a lack of fresh support, we may have to "fish" for a trade at key tested levels.

Setup 1: A test of the big weekly at 23,809.00 that gets back above the PIVOT at 23,838.00 and ultimately the daily at 23,875.00 could squeeze.

Setup 2: A hold of the daily at 23,760.00 that gets back above the pivot weekly could also squeeze.

The First Untested ETH Daily: ~23,700.00

We have an ETH daily at 23,700.00. It's not my favorite, but it's there.

Actionable Setup: I do like this for a potential failed breakdown. I would watch for a test of this zone and then for price to get back above the wick at 23,726.00 to trigger a squeeze.

The "Absolute Yes" Zone: ~23,484.00

From a 4-hour perspective, there are only one or two truly untested levels. This is the big one. It contains an untested 4-hour at 23,484.00 and an untested weekly at 23,467.00.

Actionable Setup: Everything about this zone screams "yes." The setup is to wait for price to test this area and then get back above the pivot at 23,505.00 and the ETH weekly at 23,520.00. This could be our buy.

The "Banger" / Main True Leg: 22,892.00

This is the main leg that all this "bullshit is contained in." If all else fails, a test of this level is the ultimate long opportunity, but it's a long way down.

🚨 Momentum Shift Levels

The Primary Line in the Sand: 24,044.50. This is the most important level on the chart. A hold above keeps the bullish structure intact. A failure and acceptance below the tested 23,998.75 daily is the primary bearish signal.

Secondary Pivot: The significant weekly at 23,809.00. This is the next major line in the sand if the primary pivot fails.

📌 Cheat Sheet – Key Levels Recap

🧠 Final Thoughts

The market has been on an incredible run, but it has left the support structure thin by back-testing everything on the way up. Be very careful this week. The entire structure hinges on the 24,044.50 daily pivot, especially with the huge options interest there. The plan is to see if that level holds. If it doesn't, we have a roadmap for potential failed breakdown plays at tested levels or waiting for the deep, high-conviction pullback to the truly untested zones. With FOMC on Wednesday, we could see some crazy moves.

Until next time—trade smart, stay prepared, and together we will conquer these markets!

Ryan Bailey, VICI Trading Solutions.

OPTIONS GAMMA/OPEN INTEREST LEVELS: NQ

OPTIONS GAMMA/OPEN INTEREST LEVELS: QQQ

RTH WEEKLY / DAILY + ETH DAILY

4HR ONLY

WEEKLY TPO