Welcome back. It is Saturday, September 20th, and it's time for the Weekend Review for the Nasdaq (NQ) futures. After almost six months of green, let's see what we've got going on.

The big news from last week was, of course, the FOMC announcement. They delivered the quarter-point rate cut as expected and signaled two more cuts before the end of the year. This provides a significant tailwind for the market as cheaper money allows companies to refinance and borrow, pushing indices higher. Now, let's get into the levels.

🧠 Current Market Context

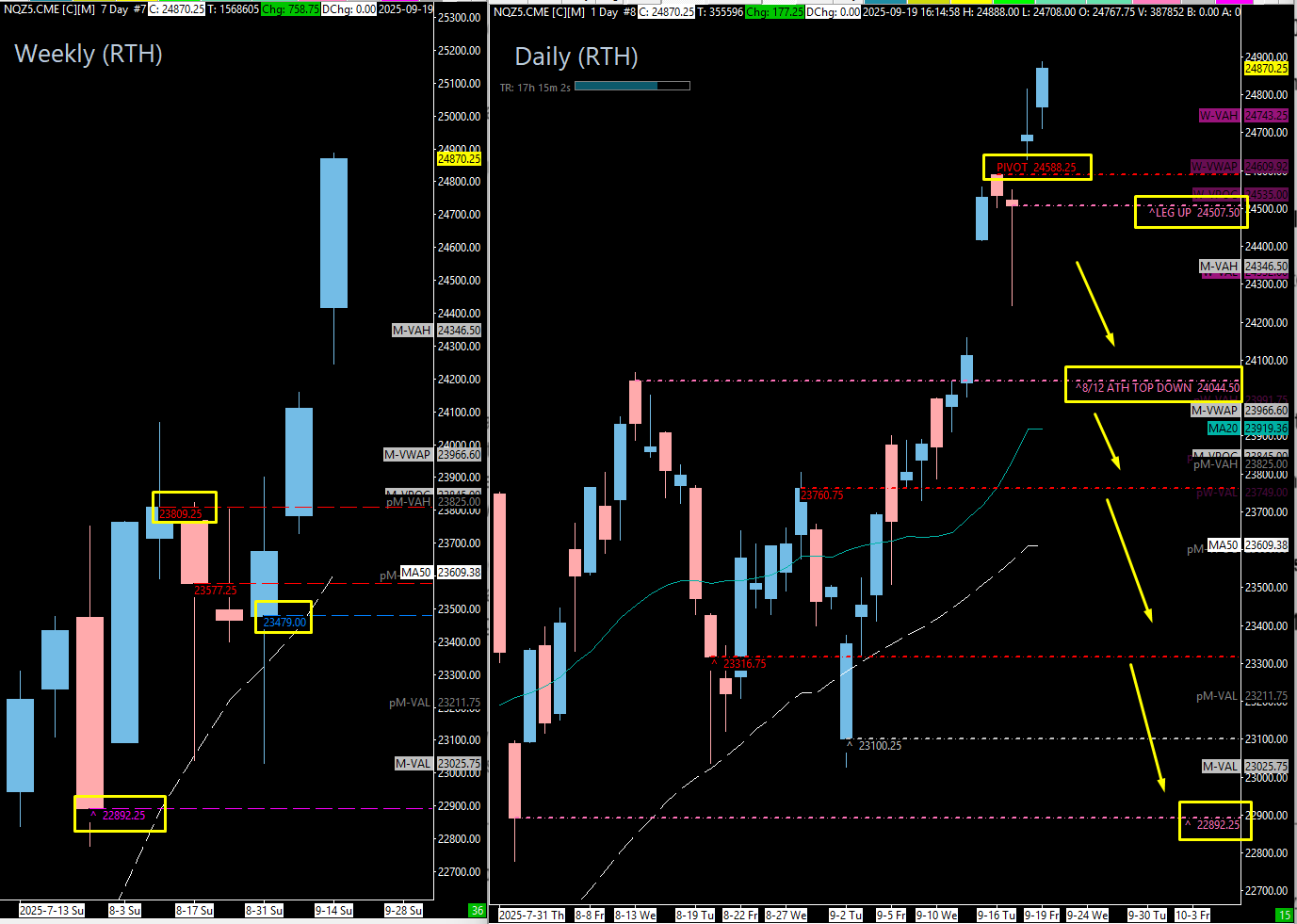

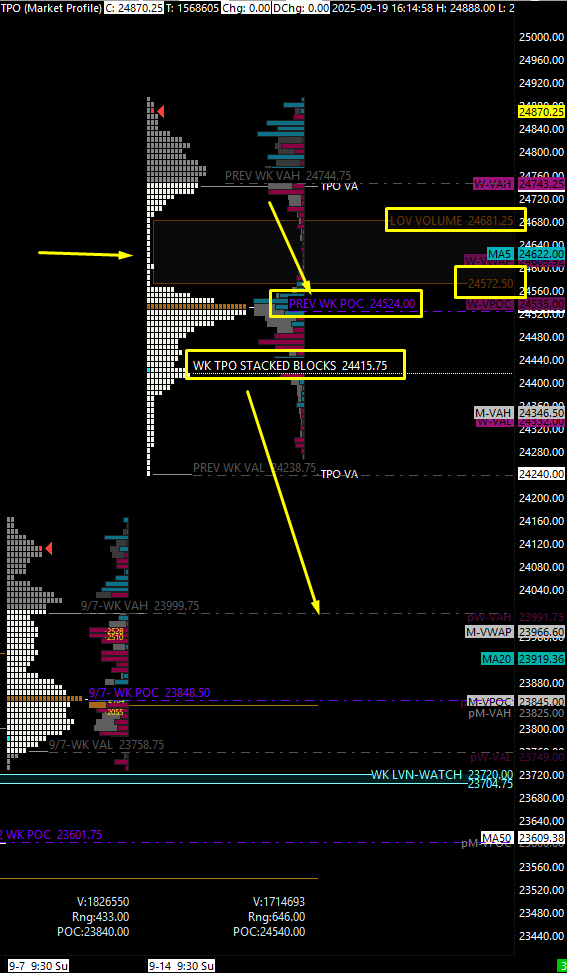

The long-term picture remains incredibly bullish. However, the weekly TPO profile reveals a more complex short-term picture. We are not in a simple balance; we are in a double distribution, with the market closing strong at the top of the upper distribution. This structure has created a significant low-volume area, or "air pocket," below us that will likely need to be tested to clean up the market inefficiency.

The problem remains the same: as we've trended up hard, nearly every level of support has been back-tested, leaving the structure thin. Our job is to identify the few remaining high-probability areas to buy on a pullback into that air pocket.

🎯 Detailed Actionable Trade Plan

🔴 Key Resistance & Upside Targets

With the market at all-time highs, there is no technical resistance. The focus is on buying pullbacks at key support.

🔵 Key Support Zones & Setups

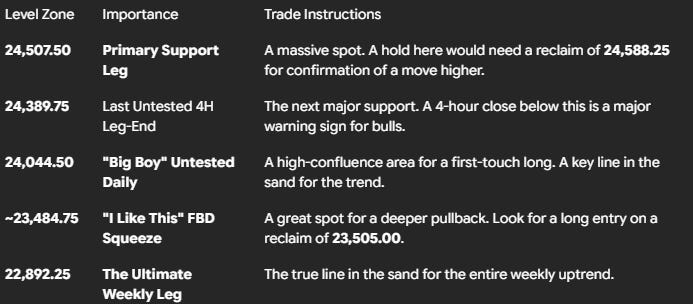

The Primary Support Leg: 24,507.50

This is our new daily leg up and a massive spot. It has confluence with a 4-hour at 24,513.00 and a large weekly TPO level at 24,524.00. We really need to hold this for our immediate continuation higher.

Actionable Setup: A long from this daily/4-hour confluence would need to see a reclaim of 24,588.25 for confirmation of progression higher.

The Last Untested 4H Leg-End: 24,389.75

This 4-hour/1-hour level is the last untested 4-hour in this leg-end. It also aligns with the stacked blocks we saw in the weekly TPO at 24,415.00.

Actionable Setup: I expect this area to hold. A 4-hour close underneath this level could lead to a significant drop.

The "Big Boy" Daily: 24,044.50

If we close the daily underneath 24,507.50, we can come all the way down to this level. This is a big boy, and it is untested.

Confluence: It has the 20-day moving average, monthly VWAP, and a previous weekly value area high all creeping up into this area.

Actionable Setup: This is a key level for us to keep in mind for first-touch support.

The "I Like This" FBD Squeeze: ~23,484.75

Deeper down, we have an untested 4-hour at 23,484.75 and an untested weekly at 23,479.00.

Actionable Setup: I believe that if price comes down, they could catch into this area. The trigger for a long would be a reclaim of the 23,505.00 swing low.

The Ultimate Weekly Leg: 22,892.25

If a major correction ensues, our true weekly leg up is way down at 22,892.25.

🚨 Momentum Shift Levels

Primary Line in the Sand: The daily leg up at 24,507.50. A daily close below this is the first major bearish signal.

Major Bull/Bear Line: The "Big Boy" daily at 24,044.50. A hold below this signifies a much deeper correction is underway and the market structure is very weak below it.

📌 Cheat Sheet – Key Levels Recap

🧠 Final Thoughts

There is not much in terms of options for support on the high timeframe. Be very careful this week. The structure is bullish, but a pullback into the "air pocket" to test a key level is a high probability. The plan is to be patient and let the market come down to our primary zones at 24,507.50 or, even better, the big boy at 24,044.50.

Have a good one.

Until next time—trade smart, stay prepared, and together we will conquer these markets!

Ryan Bailey, VICI Trading Solutions.

WK / DAILY - RTH / ETH

WK TPO