Nasdaq (NQ) Daily Trade Plan: Navigating a Whippy Options Expiration

With NQ at All-Time Highs, Here's How to Trade the 24,344.25 Pivot and the 'Favorite' Buy at 24,148.75.

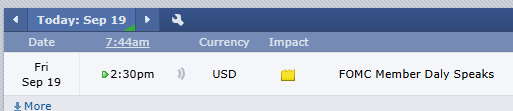

SCHEDULED NEWS: NO RED TAG

Good morning, everyone. Today is Friday, September 19th.

Yesterday was an interesting day. Price failed to move back very far, testing our significant area at 24,355.75 while holding the 24,344.00 daily, and we remained in a tight balance for most of the day. This morning, we are still percolating at the all-time highs.

Today is a very large options expiration date, so it could be a little whippy. I recommend everyone buckle up, be careful, and take solid trades. Much of our plan from yesterday was unfazed, so it will remain in effect. Let's get right into the levels.

A Note on Contract Rollover

This is the final day for me trading the old contract. I have not rolled over yet. I am still trading the September (U) contract and will be switching over to the December (Z) contract this weekend for the Weekend Review.