Hey team—Ryan here. If you’ve ever opened my Substack trade plans or the Discord levels and wondered, “Okay, what do all these colors and line styles actually mean for my next trade?”—this is your definitive guide.

My goal today is simple: show you the framework behind every chart I publish so you can read them at a glance and know where I’m looking to do business. I’m not here to teach you how to draw lines—I’m showing you the system I use every single day.

The Big Idea (Why this matters)

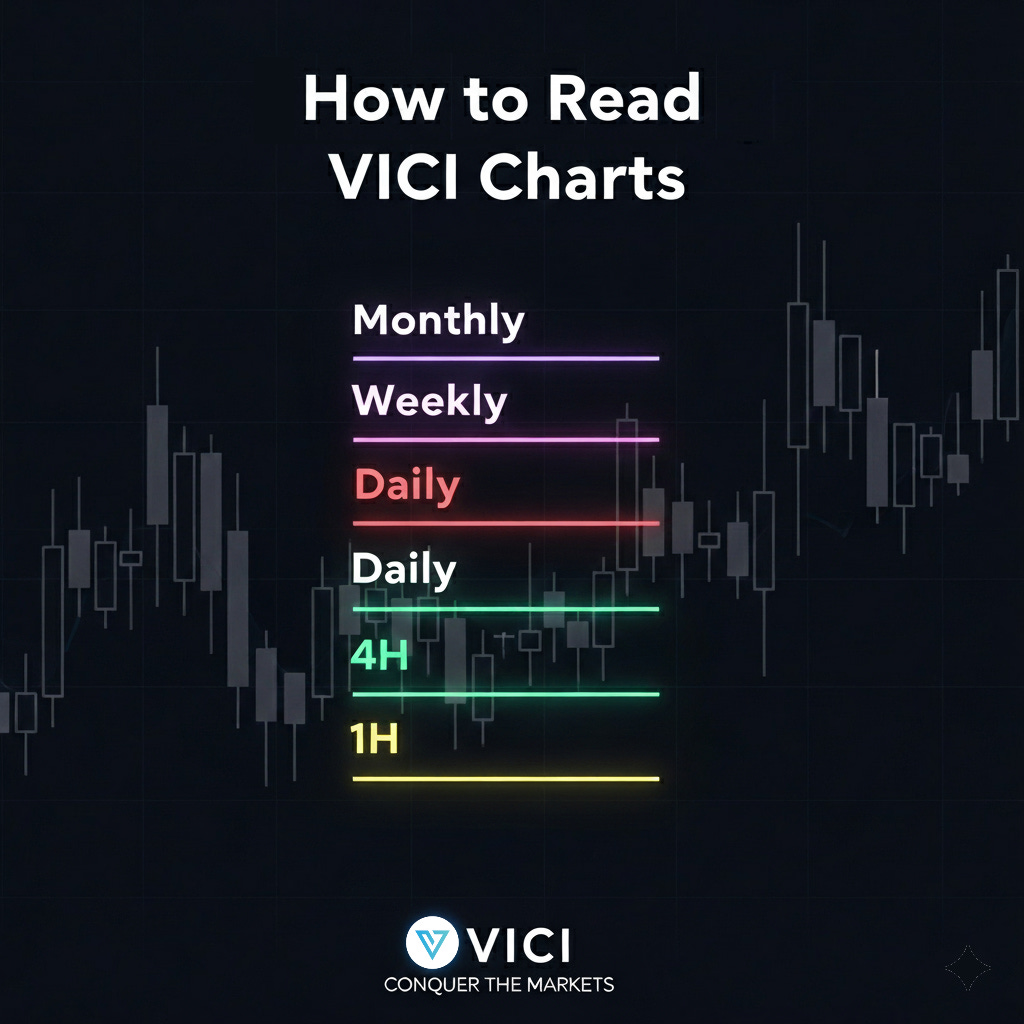

I operate a strict, top-down process: Monthly → Weekly → Daily → 4H, with occasional 1H for precision inside a zone. The higher the timeframe, the heavier the weight—the bigger the reaction I expect when price tags that level.

Key promise: Learn this legend once and you’ll immediately understand my plans—and why I’m waiting patiently for specific prices rather than chasing noise.

The Color & Line-Style Legend (Quick Reference)

Save this. Screenshot it. Tape it to your monitor.

Full chart legend with cheat sheet: CLICK HERE TO SEE POST →

🟣 Monthly (solid purple) → Highest weight; strongest reactions.

🔴 Monthly (solid red) → Tested but still significant (control above/below).🟣 Weekly (dashed purple) → Refines the big picture zones.

🔴 Weekly (red dash) → Tested yet still important for control.🩷 Daily (dotted pink) → Swing levels I reference constantly in the plan.

🔴 Daily (dotted red) → Tested but still matters (above/below significance).🟢 4-Hour (dotted green) → My primary execution timeframe.

🟢 4-Hour (dashed green) → Tested but still significant.🟡 1-Hour (dotted yellow) → Precision only inside a zone; never used to define trend.

The Framework (Top-Down in Practice)

1) Monthly — “Where the market bends”

🟣 Identifies the macro battle lines; I start here every time.

Expect the largest reactions if/when tagged.

2) Weekly — “Refining the field”

🟣 Narrows the story the monthly told us; focuses the zones we care about next.

3) Daily — “The swing map”

🩷 These are the levels I talk about all the time in the trade plan.

Great for identifying continuation or inflection within the weekly context.

4) 4-Hour — “Do business here”

🟢 My primary execution timeframe.

Where I structure the actual trades when price returns to untested levels.

5) 1-Hour — “Tighten the entry”

🟡 Occasionally used to tighten a zone or define a sweep-and-reclaim trigger inside a higher-TF area—never to set the trend.

The First-Touch Philosophy (Non-Negotiable)

I only care about untested levels. First test = best test. That’s where the clean reaction lives. If a level’s already been hit, I’m generally done with it. I wait for price to come to me for that first touch; once it tags, I move on.

Why? Reactions decay with each touch. First-touch keeps us trading fresh order-flow, not leftovers.

Reaction Size by Timeframe (How hard should it pop?)

🟣 Monthly / Weekly → biggest rotations

🩷 Daily → medium

🟢 4H → smaller, still actionable

🟡 1H → smallest; precision only

This is precisely why I favor higher timeframes and avoid scalping noise. My target is one to two trades per day max—the meat of the move—executed from pre-planned levels.

How to Use My Plans (Step-by-Step)

🔎 Start at the top: Read the narrative bias in the plan, then scan Monthly → Weekly → Daily to see the bigger story.

🗺️ Locate today’s business zones: Find the 4H levels that align with the higher-TF story.

🎯 Mark the first-touch candidates: Prioritize untested levels; set resting orders if it fits your playbook.

🧭 Use 1H for precision (optional): If price is dancing within a zone, a 1H micro-level can help define a sweep-and-reclaim or a tighter stop—without changing the trend call.

⏳ Be patient: If it doesn’t come to the level, the trade’s missed. No chasing. We’re running a process, not a slot machine.

🧠 Remember the weight: Expect larger rotation off Weekly/Daily; scale expectations down as you go lower in time frame.

Final Word

Everything I publish—Substack plans, Discord levels—comes from this exact system: top-down analysis, color-coded levels, and a strict first-touch rule. Learn the legend once and you’ll know exactly how I’m thinking and what reactions to expect at each line.

Until next time—trade smart, stay prepared, and together we will conquer these markets!

Ryan Bailey, VICI Trading Solutions.