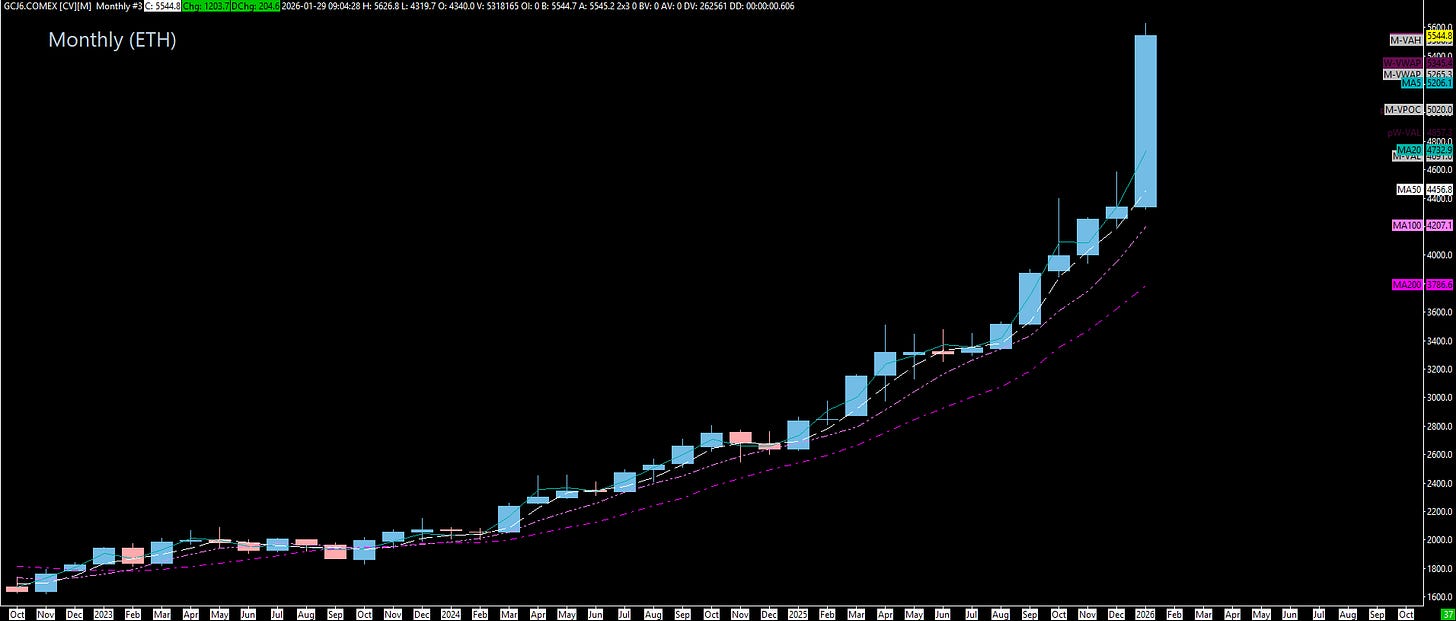

Gold Hits $5,600: The Market Is Screaming Something...Are You Listening?

Dollar Weakness + Geopolitical Chaos = Rocket Fuel for Precious Metals. See How Historical Data Predicted Volatility for Equities In the Past.

Gold Bugs,

Let’s talk about something that’s never happened before in our lifetime.

Gold just hit $5,600 per ounce. Silver topped $120.

If you’re not paying attention to this, you should be. This isn’t some minor breakout or technical level getting tested. This is the market screaming at the top of its lungs that something is fundamentally broken.

Why This Matters

Gold and silver don’t rally like this unless investors are terrified of something. These are safe-haven assets—the things you buy when you don’t trust anything else. Stocks? Too risky. Bonds? Questionable. Cash? Losing value to inflation. So they run to metals.

Here’s the kicker: this has never happened before. Gold has never been above $5,300. Silver has never touched $120. We are in uncharted territory.

What’s Driving This?

Three things:

1. Dollar Weakness

Treasury Secretary Bessent came out yesterday defending the “strong dollar policy,” but the market isn’t buying it. When officials start talking about currency strength, it usually means they’re worried about currency weakness. The dollar has been under pressure, and when the dollar falls, gold rises. It’s physics.

2. Geopolitical Chaos

Uncertainty is rocket fuel for metals. Whether it’s trade tensions, global instability, or policy confusion—when the world feels shaky, money flows into hard assets. Right now, the world feels very shaky.

3. Flight to Safety

Investors are pulling money out of risk assets and parking it in gold and silver. This is a classic risk-off move. And when risk comes off the table in a big way, equities tend to follow.

What This Means for Equity Traders

If you’re trading ES, SPX, or VIX, you need to watch this closely.

Gold rallies of this magnitude are often leading indicators of equity market corrections. Not always, but often enough that you can’t ignore it. When investors are this scared, they don’t discriminate—they sell stocks, they sell bonds, they sell everything that isn’t bolted down, and they buy gold.

The correlation to watch: Gold up + VIX up = bad news for equities.

We saw gold spike during the 2008 financial crisis. We saw it during the COVID crash. We saw it during the European debt crisis. Every time gold goes parabolic, it’s because the market is pricing in serious trouble ahead.

Historical Context: The Numbers Don’t Lie

Let me give you some perspective.

• 2008 Financial Crisis: Gold went from $800 to $1,900 (up 138%) over three years. The S&P 500 crashed 57%.

• COVID Crash (2020): Gold spiked from $1,450 to $2,070 (up 43%) in six months. The S&P dropped 34%.

• European Debt Crisis (2011): Gold rallied from $1,300 to $1,900 (up 46%). The S&P fell 19%.

Now look at today: Gold is up over 40% from its lows earlier this year, and it’s accelerating. Silver is up even more. This isn’t a gentle drift higher—this is a parabolic move.

Parabolic moves in safe-haven assets don’t happen in healthy markets. They happen when smart money is getting the hell out of risk assets and into anything that can’t be printed, devalued, or manipulated.

What Should You Do?

If you’re trading equities, tighten your stops. When gold and silver are rallying like this, it’s a warning shot. The market might keep grinding higher in the short term, but the setup for a major correction is building.

Watch VIX closely. If VIX starts to spike alongside gold, that’s your signal that fear is taking over. Risk-off doesn’t happen slowly—it happens fast.

If you’re long equities, consider hedging. If you’re looking for entries, wait for better setups. Don’t chase a market that’s being held up by fumes while safe-haven assets are screaming “danger ahead.”

The Bottom Line

Gold at $5,600 and silver at $120 isn’t just a headline. It’s a message.

The market is telling you that uncertainty is high, confidence is low, and risk appetite is fading. When investors are this scared, they buy gold. And when they’re buying this much gold, it usually means trouble is coming for everything else.

Stay sharp. Stay prepared. And don’t ignore what the metals are telling you.

Until next time—trade smart, stay prepared, and together we will conquer these markets!

—Ryan Bailey

VICI Trading Solutions