Good evening, everyone. It’s Saturday, September 6, 2025, and tonight we're chart surfing Gold. It’s funny to see social media just now waking up to the Gold breakout, because for anyone who has been following our work, this is no mystery. We’ve been all over this for months, and the fundamental thesis remains stronger than ever: continued stimulus, the prospect of lower interest rates, and the systematic devaluation of the dollar are the rocket fuel for this rally.

🧠 Current Market Context:

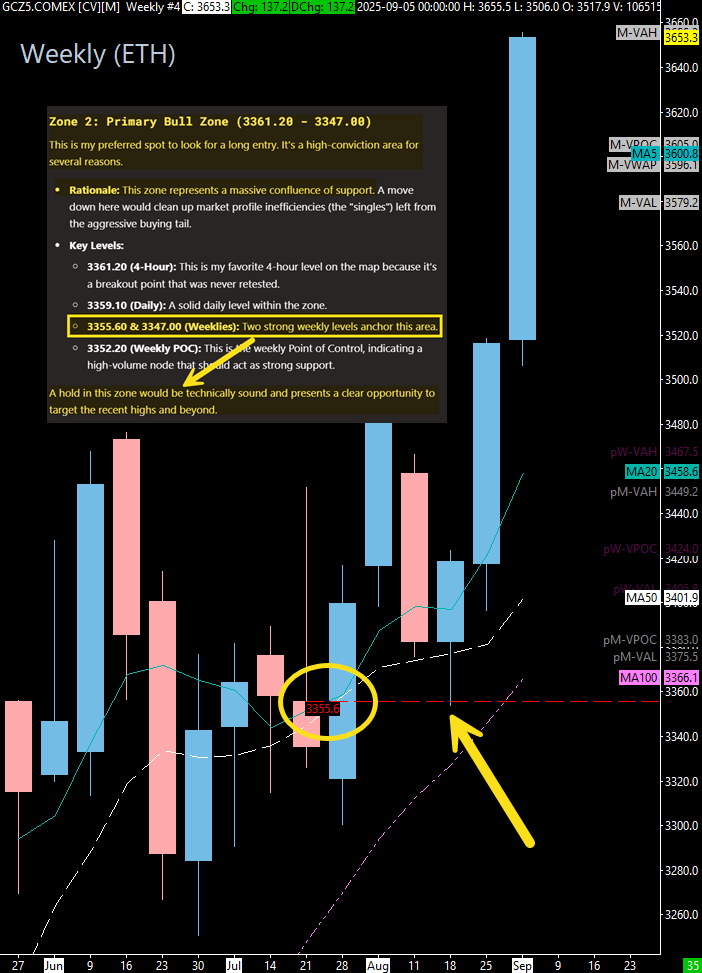

I saw a meme the other day that perfectly captures the current environment: "The cost of gold is not going up. Your currency is just worth less". That is precisely what is happening. As the value of the U.S. dollar is pushed lower, the price of Gold in USD terms naturally rises. This isn't a short-term trend; we are likely in a multi-year cycle of dollar devaluation, which means assets like Gold, Bitcoin, and equities should continue to rise. This thing is on a moon mission and is already up well over 100% since 2024. The trend is insanely bullish, and our strategy remains simple: every significant dip is a buying opportunity.