After the Freefall: What a 30% VIX Spike Tells Us About Next Week

Analyzing Friday’s 200-point S&P 500 sell-off, Trump’s tariff tweet, and what 32 years of data says about a market bounce after a major panic event.

Hello Traders,

If you were watching the market on Friday, you felt it. The slow grind down in the S&P 500 suddenly accelerated into a freefall, shedding over 200 points in a wave of panic selling. The catalyst was a tweet from President Trump announcing his intention to pursue 100% tariffs on all Chinese imports, sending a jolt of uncertainty through the market.

The result? The VIX, the market’s “fear gauge,” exploded higher by over 30%—the most violent single-day spike we’ve seen in 6 months (April 2025).

Days like Friday are designed to spark fear and emotional decisions. But as professional traders, our job is to ignore the noise, look at the data, and ask one simple question: When acute panic like this hits the market, what usually happens next?

I did a deep dive into over 30 years of market data to answer that question. The results provide a clear, statistical edge for what to expect on Monday.

The Data on Panic Spikes

A spike of over 20% in the VIX is a rare and powerful event. It signals that fear has turned into outright panic, often leading to a capitulation or “washout” of sellers. This exhaustion is what creates the conditions for a sharp, short-term rally.

To get the full picture, I ran the numbers on two scenarios dating back to 1993.

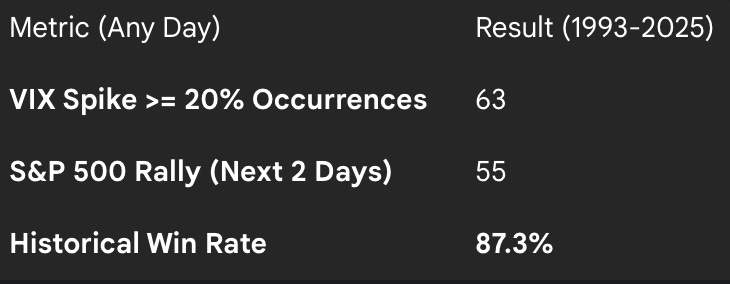

Analysis 1: VIX Spike of 20%+ on Any Trading Day

*This is the broadest measure of a panic event.*

Historically, the market has bounced back on either the next or the second day a stunning 87.3% of the time.

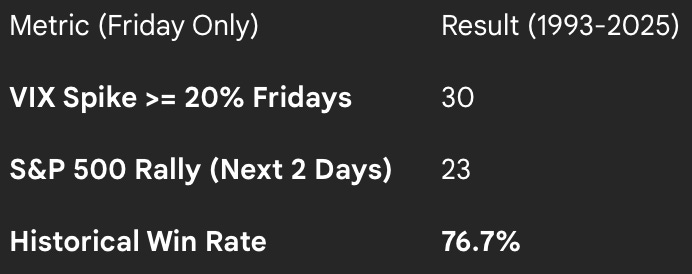

Analysis 2: VIX Spike of 20%+ on a Friday

This is the exact scenario we saw this week. What does the data say about these weekend fear events?

When the panic spike happens on a Friday, the probability of a rally on Monday or Tuesday is still a very powerful 76.7%.

What This Means for Monday

As traders we never “KNOW” exactly what will happen or when. We base our edge off of mathematical probabilities & if the odds are in our favor we size and trade accordingly. Let’s be clear: this data is not a crystal ball. It doesn’t guarantee the ultimate low is in. However, it provides an undeniable statistical tailwind for a short-term bounce.

The numbers suggest there is a 77% to 87% probability that we will see a positive close on either Monday or Tuesday. This means that entering the new week, we should be on high alert for signs of stabilization and a potential “snap-back” rally.

Fearful events create incredible opportunities for those who are prepared. While the headlines are screaming panic, three decades of data are quietly pointing to a high likelihood of a relief bounce.

We will trade the market that’s in front of us, but we will do it with the confidence that the historical odds are firmly on our side.

Until next time—trade smart, stay prepared, and together we will conquer these markets.

Ryan Bailey

VICI Trading Solutions